Impression supply: Getty Photos

Home advancement tasks can raise the benefit of your property and make your place much more livable. Regrettably, they are generally highly-priced and lots of people today have to have to borrow in purchase to make large modifications to their qualities.

If you are funding residence advancements by way of credit card debt as a substitute of spending for them out of financial savings, it is critical to pick the ideal type of personal loan. You have a number of alternatives, which include securing a own loan or getting out a 2nd house loan or hard cash-out refi bank loan on your residence.

Whilst numerous people today default to getting out a dwelling mortgage since they’re making use of the resources to enhance their property, particular financial loans can really be a excellent choice resource of funding in some instances. To enable you choose if a individual bank loan or a property finance loan is the best option for you, think about these professionals and drawbacks.

Pros of paying for household improvements with a personalized mortgage

Listed here are some of the most important strengths of utilizing a personal mortgage to pay out for home improvements.

- It can be more quickly and much easier to get authorised: House loan loans — like second home loans and money out refis — can in some cases have a lengthy acceptance course of action. It can consider weeks, and involve a great deal of economic paperwork, just before a mortgage is accepted and dollars is designed available. There could also be heaps of hurdles to bounce by, together with acquiring a household appraised. Personalized loans, on the other hand, have a less complicated application process and funding can generally be manufactured obtainable quickly — at times, as quickly as a number of days after making use of.

- The financial debt is unsecured so your property isn’t on the line: A lot of particular financial loans are unsecured credit card debt, which means there is no collateral guaranteeing the financial loan. By distinction, home loan financial loans are secured personal debt and the residence ensures the bank loan. As a final result, if you turn into unable to repay it, you could drop your house.

- You’ll steer clear of closing charges: Securing a money out refi or a initially or 2nd home finance loan personal loan can require you to shell out countless numbers of bucks in upfront closing expenditures. You may possibly have to have to pay out a mortgage origination fee, title insurance coverage prices, and appraisal expenses — among other costs. By contrast, numerous personal loans have lower or no software costs so you do not need to come up with hundreds of bucks just to be capable to borrow.

Cons of spending for residence advancements with a personalized personal loan

There are also some downsides of opting for a particular financial loan, rather than having out some sort of home finance loan bank loan when you are improving upon your home. Right here are a few of them.

- Your fascination amount will very likely be greater: Given that personalized financial loans are generally unsecured debt, they are riskier for lenders than secured home loans. As a result, they may well have a significantly greater curiosity rate. Mortgages are normally a person of the solitary most inexpensive techniques to borrow.

- Your every month payment could be higher: Individual loans may possibly have a shorter repayment period of time and a increased fee than mortgage loans. As a end result, your month to month payment could be higher with a personal personal loan utilized to finance property improvements than with a home loan. This could put much more strain on your budget.

- You will not be capable to deduct desire on your taxes: Home finance loan fascination — together with on next home loans — is ordinarily tax deductible if you itemize (in particular if the money are utilized to pay out for residence updates). If you can deduct curiosity fees, the government subsidizes your borrowing. By contrast, fascination just isn’t deductible on private financial loans, so you don’t get this borrowing reward.

So, which technique is ideal for you? In the long run, it relies upon on your targets, the type of private financial loan or mortgage loan you can qualify for, the volume you happen to be borrowing, and your payoff timeline. You ought to cautiously think about every single solution to decide which would make the most feeling for your condition in light-weight of equally the advantages and drawbacks of each and every funding process.

A historic possibility to possibly conserve 1000’s on your home finance loan

Probabilities are, desire charges will not keep place at multi-decade lows for substantially for a longer period. That’s why using action currently is vital, no matter whether you’re seeking to refinance and reduce your mortgage loan payment or you’re all set to pull the cause on a new dwelling buy.

Our professional suggests this enterprise to obtain a very low price – and in point he made use of them himself to refi (twice!).

We’re agency believers in the Golden Rule, which is why editorial viewpoints are ours by yourself and have not been beforehand reviewed, authorized, or endorsed by integrated advertisers.

The Ascent does not cover all delivers on the marketplace. Editorial articles from The Ascent is different from The Motley Fool editorial content material and is designed by a various analyst staff.The Motley Idiot has a disclosure policy.

The sights and views expressed herein are the sights and viewpoints of the writer and do not always replicate those of Nasdaq, Inc.

More Stories

House Loan Prepayment Tips to Reduce Interest

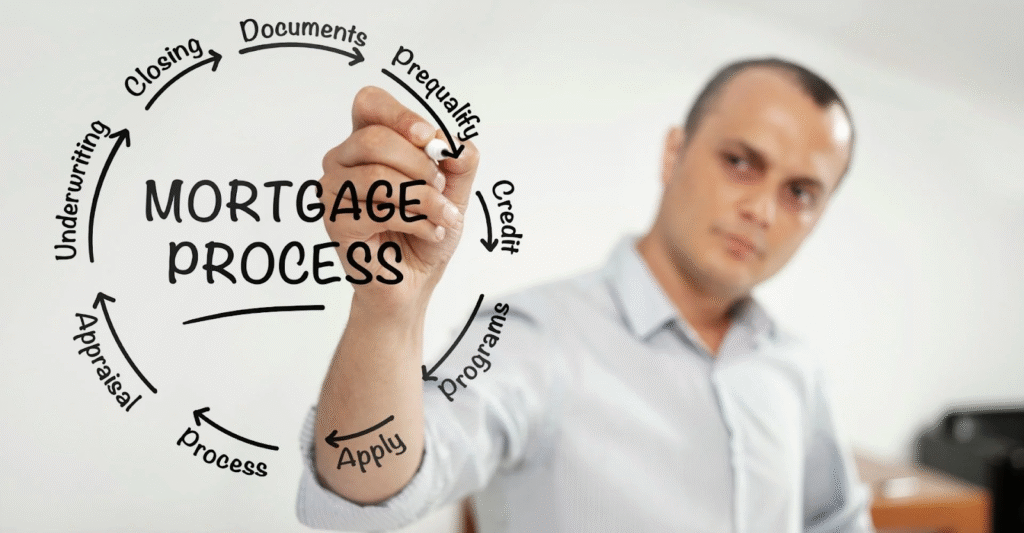

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need