Image source: Getty Pictures

You could want to favor a household equity bank loan for just one huge motive.

Crucial details

- Both of those a residence fairness mortgage and a HELOC enable you borrow towards your home.

- Residence fairness financial loans could be a superior wager this yr owing to the way desire fees could development.

One reward of currently being a house owner is receiving to tap the dwelling equity you’ve created in your assets. You can borrow versus that fairness for a wide variety of uses, whether it’s to repair difficulties with your house, make renovations, or use the dollars for something not related to your assets, like start out a smaller organization or go on trip.

Appropriate now, homeowners across the U.S. are sitting on a substantial amount of fairness owing to larger home values. And you may perhaps be eager to faucet yours.

If you really don’t want to consider out a new home finance loan (specifically, a hard cash-out refinance) to obtain that fairness, you can borrow against your property by using a home fairness financial loan or line of credit score (HELOC). Both of those selections have their advantages and disadvantages, but you might want to favor a home equity financial loan this yr for a person big rationale.

It is really all about fascination rates

A person benefit of using out a residence equity mortgage more than a HELOC is receiving to lock in a preset desire rate on the sum you borrow. This makes certain your payments will never increase in the program of paying off your loan.

With a HELOC, you get extra flexibility in the total you borrow since you are not getting out a lump sum financial loan ideal away. Relatively, you get a line of credit you can draw from over the program of what’s typically 5 to 10 a long time. But HELOC curiosity prices can be variable, which usually means that as soon as you attract from your HELOC, your curiosity fee could increase in the program of your repayment time period.

In the meantime, there is certainly a good likelihood desire charges will rise this year on consumer solutions across the board. The Federal Reserve has designs to raise its federal funds amount.

Now to be very clear, the Fed will not likely dictate what desire charge you pay out on your house fairness mortgage or HELOC simply because it won’t really establish shopper curiosity costs. Rather, it targets what costs financial institutions cost every other for shorter-time period borrowing. But the Fed’s actions are inclined to influence shopper premiums, and so this year, it really is reasonable to suppose rates will start out to climb. And they may well continue on to climb for decades immediately after.

That is why if you happen to be likely to borrow towards your house, it could possibly pay out to lock in a household equity bank loan — quickly. With rates beginning to rise, you may well want the security of acquiring a preset fascination level on the sum you borrow — and predictable payments to observe.

How to obtain a household equity mortgage

As is the situation with any financial loan you acquire out, it pays to store close to with various property equity creditors to see which types are presenting the most aggressive interest charges. Also, be aware that you’ll be billed costs to near on that loan, so you can expect to want to spend awareness to those people, too.

In the meantime, with household fairness degrees currently being so large, you might be tempted to err on the aspect of borrowing a lot more fairly than fewer. But try to remember that falling powering on a residence equity mortgage can have severe effects, like possibly, in intense conditions, getting rid of your property. Right before you sign a mortgage, make confident you happen to be truly only borrowing the amount you need to have, and are not borrowing extra.

A historic option to perhaps save 1000’s on your property finance loan

Prospects are, curiosity premiums will never keep put at multi-10 years lows for significantly lengthier. Which is why taking action today is very important, irrespective of whether you are wanting to refinance and cut your mortgage loan payment or you might be ready to pull the bring about on a new home invest in.

The Ascent’s in-dwelling home loans pro suggests this company to find a low rate – and in point he used them himself to refi (two times!). Click listed here to understand more and see your amount. While it doesn’t affect our views of solutions, we do get compensation from associates whose features seem here. We are on your side, normally. See The Ascent’s full advertiser disclosure here.

More Stories

House Loan Prepayment Tips to Reduce Interest

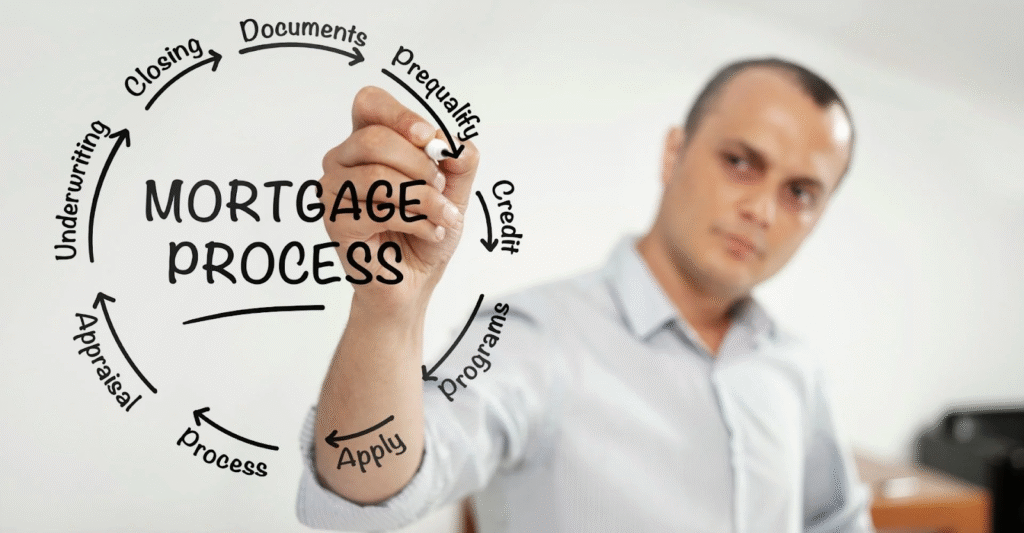

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need