After overcoming so numerous obstructions, some younger workers thrive in purchasing a household in Ho Chi Minh City, but there are several other people who can’t hold on to their aspiration for very long owing to unforeseen gatherings.

In buy to have a spot in the metropolis, a lot of youthful staff select to acquire residences in installments. Most of them are forced to give up leisure actions to pay off the residence.

Some of them even postpone their ideas to have a baby for the reason that they have to focus on having to pay back housing loans.

Whilst some are fortunate plenty of to find the money for the monthly installments, a lot of people today have to give up their housing desire after they operate out of spending budget.

Worried to have a boy or girl

Like other young couples in Ho Chi Minh City, Tran Mai Linh and her spouse, who stay in Thu Duc Metropolis, yearned for a home despite their lower cash flow.

In 2015, they located a appropriate condominium in Linh Trung Ward, Thu Duc Town just after a long look for.

They paid out VND300 million (US$12,932) in advance for the condominium, which was marketed for VND1.6 billion ($68,973).

Linh is an place of work worker and her husband is a manager in a garment manufacturing unit.

Their complete monthly profits is just more than VND20 million ($862).

In spite of the limited spending budget and foreseeable pitfalls, the few were determined to get the flat.

“We thought that getting an condominium would power us to perform two or three situations tougher than regular,” Linh mentioned.

“We downplayed the issues and said that this final decision could impact our wellness or, in the worst situation, we would not be capable to pay out the debt.”

Getting previously bought the apartment, the few experienced to work even more challenging to fork out back the debt each and every thirty day period.

Their economic stress grew over time, when month-to-month payments accounted for more than 50 % of their complete profits, not to point out dwelling fees and unanticipated diseases.

“Most of the time we do not have any funds still left over, it’s just ample, or often we have a shortage,” Linh sighed.

The couple also postponed their options to have a little one pursuing the invest in of the apartment.

“Our life as a few is previously so challenging, if we experienced a little one, the house would grow to be a heavier burden,” Linh stated sadly.

When a pregnancy take a look at returned a beneficial outcome, the 25-year-old youthful lady opted for an abortion, even though her parents ended up looking ahead to owning a grandchild.

“Being pregnant needs really superior treatment, plus money for newborn formulation, diapers, and other costs. We do not dare to have a youngster at the moment,” explained the girl from the highland province of Gia Lai.

Fortunately, the quantity they have to pay each month has shrunk more than the earlier eight years.

Now, they only fork out beneath VND4 million ($172) for each thirty day period, in accordance to Linh’s partner.

Personal debt obsession

Nguyen Thanh Nam, a resident of Binh Tan District in Ho Chi Minh City, has experienced quite a few sleepless nights in the latest decades stressing about getting homes.

In May 2021, Nam divorced his wife and offered the apartment they had lived in for five decades.

At the time of the sale, they had been nonetheless spending off the bank’s installment prepare.

In 2016, when Nam and his wife came to Ho Chi Minh Town, they made a decision to obtain an apartment.

At that time, they acquired a 67-sq.-meter unit with two bathrooms at VND1.3 billion ($56,040) in Binh Tan.

While several persons warned them of achievable pitfalls, the few took out a mortgage of 70 per cent of the benefit of the condominium and were being obliged to pay back practically VND15 million ($647) month-to-month, such as the principal and fascination.

They enjoyed the pleasure of owning their possess residence for only 3 months, and then felt totally pressured when the owing date came.

“We dreaded the day when we have been required to fork out the installment,” Nam recalled.

“The tenth day of the month was the owing day, but it really is so demanding as we did not obtain our income on the 5th working day that we had to borrow income from all forms of resources like friends or family members.”

They saved for a whilst and gathered VND200 million ($8,621) to fork out the bank loan.

Despite the bank loan acquiring little by little decreased above the preceding five several years, their romantic relationship finished in May perhaps final 12 months, a single of the explanations being their dispute about the financial institution bank loan for the property.

Simply because of the divorce, they sold the house.

“Proper now, I have no intention of shopping for a house in the city any more,” 34-calendar year-outdated gentleman Nam mentioned.

“I lease homes wherever I want.

“If I could make that conclusion once more, I would not get the condominium.

“It set so much pressure on me.”

Nam believes that young men and women like him ought to assume 2 times prior to shopping for a household.

“They say financial debt tends to make us function more durable, but in truth we need to know what we are performing,” he remarked.

“If you do not have a fantastic-having to pay career, you are far better off giving up!”

Selling the dwelling even though he will not stay a solitary working day

Hoang Huy, a resident of Binh Thanh District, Ho Chi Minh Town is a different person who confronted lots of hurdles while striving to safe an condominium right here.

He signed up to purchase a device that was still remaining built.

The gentleman was entitled to a lower price tag with a purchase prepare this way, Huy explained.

The apartment, worth VND1.7 billion ($73,283) at the time of its completion, is located on Countrywide Street No. 13 close to Thuan An Town in Binh Duong Province, just outside Ho Chi Minh City.

The youthful person from the central province of Quang Nam intended to pay out 30 % of the value gradually around a few or four a long time.

His strategy was to implement for a bank loan until he gets the apartment, and then acquire out a property finance loan of 70 per cent of the apartment’s value.

He could have understood his desire if the COVID-19 pandemic had not occurred.

His revenue was seriously influenced by the pandemic so Huy had no decision but to promote his aspiration apartment immediately after he had presently compensated VND200 million ($8,621).

Huy not only parted with the very long-preferred house but also suffered a decline of 20 p.c.

“I was luckier than other individuals to be ready to sell the apartment,” said the younger salaried worker.

“Several persons are unable to and have to live with the credit card debt and worry for a long time.”

Town home pride

“We once believed that we must have our possess house, as the thought of being in a position to return to our house just after operate built us overjoyed,” explained Nam, the Binh Tan dweller.

“We thought that if we did our very best, we would pay out off the loan for the dwelling in 10-15 a long time.

“Besides, to our hometown kin it is truly admirable to be able to manage a property in the town, which motivated us test more difficult to be acknowledged.”

Like us on Fb or follow us on Twitter to get the newest information about Vietnam!

More Stories

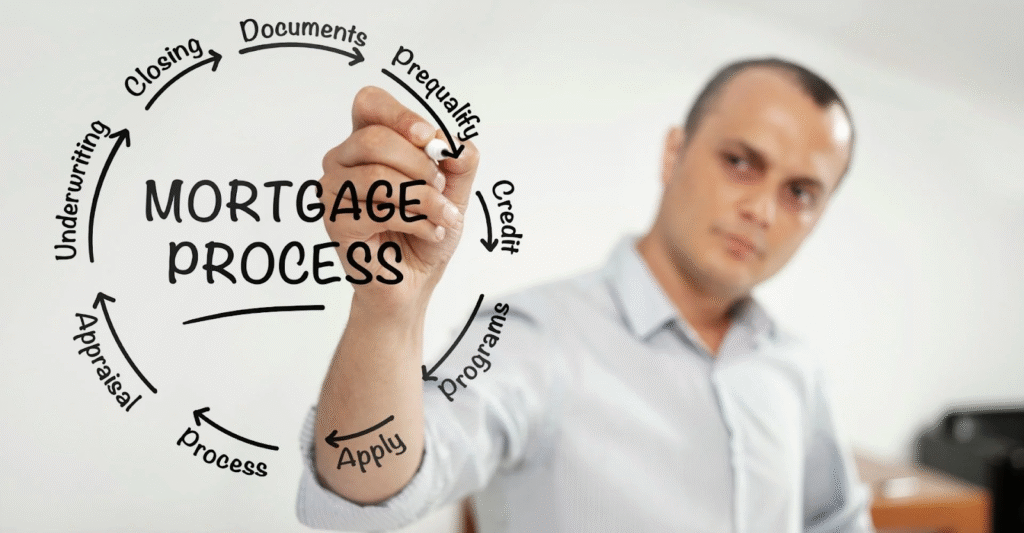

House Loan Prepayment Tips to Reduce Interest

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need