A Federal Way rambler. A Covington four-bedroom with a “cozy gas fire.” A pale blue two-tale household in an Auburn subdivision.

Considering that the start out of the pandemic, these and additional than a dozen other King County houses sold just days just after currently being stated. But in contrast to other individuals in the region’s incredibly hot housing market place, the homes did not go to consumers seeking to protected their initially place or browsing for much larger suburban households to work from house.

The purchaser was Invitation Residences, a property management enterprise that rents some 80,000 households across the region and was made by Wall Road big Blackstone following the economic disaster (then later on sold off by the investment decision firm).

Invitation Homes is section of a compact but escalating share of homebuyers in Seattle: traders ranging from tiny-time flippers and landlords to significant-scale investment decision firms.

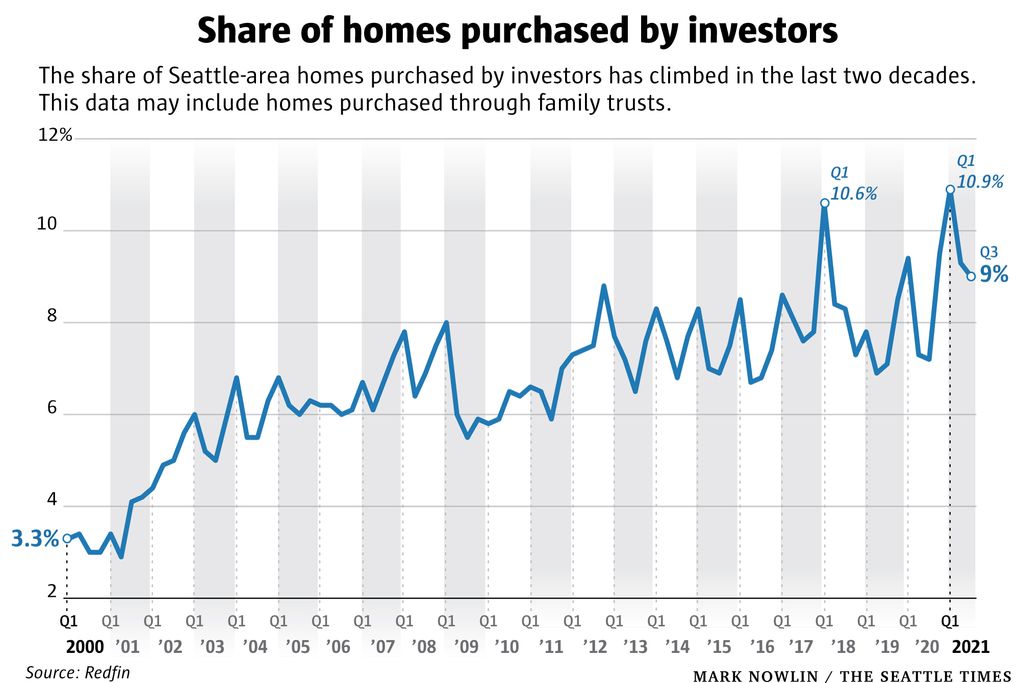

The share of Seattle-region properties marketed to buyers has climbed steadily more than the earlier two many years — from about 3% in 2000 to 9% this drop — in accordance to facts introduced by Redfin this week. Other measures change, relying on how “investor” is defined. These range from 6% to 29% of all property product sales.

It’s not just right here. All around the nation, Wall Road landlords, pension funds and flippers are on the lookout to income in on the immediate increase in dwelling price ranges and rents. That’s putting them in opposition with 1st-time consumers seeking to claw their way into the country’s primary source of prosperity-constructing: homeownership.

Nationally, buyers purchased a record-superior 18% of the residences marketed in the third quarter of this calendar year, and investors ever more turned to one-household residences, in accordance to Redfin.

“Investors eager to acquire households are heading to thrust up from folks who want to dwell in them,” explained Daryl Fairweather, chief economist at Redfin.

Still, buyers by itself can not reveal Seattle’s more and more out-of-get to housing marketplace. Personal purchasers with funds from shares or the sale of their last household push bidding wars, in some cases with all-dollars gives.

“We have scarce housing and a lot of people today doing the job below making a large amount of revenue,” explained Gregg Colburn, a University of Washington assistant professor who has analyzed the methods of institutional buyers and has a forthcoming e book on housing and homelessness. “To a sure extent, we’ve established our personal dilemma.”

It is a popular tale in the Seattle area’s aggressive marketplace: Following a grueling research for their to start with property and several failed gives, program developer Johnathan Lyman and his spouse found them selves as 1 of at the very least 20 parties making gives on a 4-bedroom house in Auburn.

They ended up amid the greatest bids, but experienced to kick in additional earnest funds (basically a nonrefundable deposit to the vendor) in order to win. The residence was mentioned for $480,000. In the close, they paid out $550,000.

It didn’t choose a Wall Street agency to generate that bidding war. “Us specific consumers certainly experienced no hassle pushing up the rate,” Lyman stated.

“Seeing the opportunity”

In the years pursuing the housing crash in 2008, trader buys soared. Foreclosures drove housing price ranges down and the range of renters up. A flood of large buyers appeared to capitalize and extra one-family members properties became rentals.

Now, soaring house costs are narrowing some gain margins, but investor desire is specially significant in Sunbelt cities these as Atlanta, Phoenix and Miami, according to Redfin.

Economists say an array of factors is driving trader interest: Interest charges are minimal, mounting home price ranges assure a great return on financial commitment and investors may be catching up on buys they put off very last year, mentioned Thomas Malone, an economist at CoreLogic.

Rapidly-mounting rents and an finish to pandemic tenant protections guarantee more return for trader landlords.

New tendencies could be taking part in a smaller purpose, too. Algorithm-based mostly flipping known as iBuying is probable powering about 10% of the surge, Malone said. Create-to-rent projects, in which investors develop single-spouse and children houses particularly to hire, are turning into additional common.

“It’s a hen-and-egg problem,” Malone explained. “Are buyers generating the superior rates or are they seeing superior selling prices and chasing after them?”

In the Seattle space, folks wanting to rehab and resell homes or operate rentals are “seeing the opportunity” simply because of high price tag appreciation and simpler obtain to funding, said Jim Melgard, vice president of revenue at Eastside Funding, which lends dollars to traders. He estimates his organization is approximately 70% flippers and 30% landlords.

Parsing the share of Seattle buyers on the lookout for financial commitment attributes, and how numerous are residence-flippers as opposed to landlords, is elaborate. That will make it harder to observe and have an understanding of the implications. King County, for illustration, records extra than 60,000 deeds every single 12 months and could not deliver a breakdown of the prime traders. Substantial organizations may use several LLCs.

To estimate the range of investors, Redfin looked for prospective buyers whose title in buying documents incorporated one particular of a handful of keyword phrases, these as “LLC,” “Corp,” “joint venture” and “corporate trust.”

Their knowledge might consist of some buyers who strategy to reside in their properties but use a spouse and children have confidence in or an LLC to near the deal. LLCs, which conceal the buyer’s identity, are a common tactic for wealthy buyers.

Another evaluate, by ATTOM Facts Solutions, appeared just for institutional investors who purchased at the very least 10 attributes in a 12 months. Individuals made up about 6% of one-household home and condominium income in Seattle, Tacoma and Bellevue in the 3rd quarter this 12 months, up from 2% at the same time in 2020.

A broader glance finds a considerably larger share. CoreLogic counts any person or corporation who owned three or far more attributes at the exact time in the last ten years as an trader. By that measure, 13% of single-household household income in the Seattle place previous 12 months went to traders. In September: almost 29%.

This method may possibly depend an investor’s personal property along with their investments, but is possible to mirror far more tiny-scale investors than the other counts, stated Malone, from CoreLogic.

By Redfin’s evaluate, some of the places in the vicinity of Seattle with the most investor curiosity are also some of the richest: Medina, Bellevue, Mercer Island and Kirkland. ZIP codes in Shoreline and the College District also noticed large trader buys.

The focus on the Eastside, the place the median residence cost is almost $1.4 million, “speaks to prosperity inequality,” Fairweather stated.

Pricey areas are a harmless bet because “there are likely to continue on to be individuals who want to are living in Bellevue and on the water. Those people individuals maintain obtaining richer and they will be ready to afford to pay for increased lease, will be ready to find the money for better home prices,” she said.

Much more very affordable places like Federal Way, Kent, Auburn and Tacoma also attract fascination from traders, together with people wanting to flip, Melgard mentioned. “People have started to develop out to Aberdeen and Centralia,” he stated.

Even without having buyers, price ranges climb

Meanwhile, specific prospective buyers have appeared to new tactics to compete in the competitive market in current yrs.

To offer you a lot more dollars, Seattle-space purchasers are tapping into shares, equity from marketing their very last residence, gifts from spouse and children customers and, at times, cryptocurrency, reported Aaron Crossley, a lender with Kirkland-based Caliber Residence Loans.

Customers commonly waive protections, these types of as their suitable to an inspection. And following heartbreaking lookups, some uncover on their own giving extra and additional money to attempt to acquire.

“Investors have a bottom line,” claimed Ann Nordling, proprietor and controlling broker of the TRI STAR Team at RE/MAX. “End buyers have a tendency to be more emotionally attached to the final result and inclined to spend far more.”

The location faces a scarcity of homes both to get and to hire, and thousands of workers earning small wages commute a lot more than 25 miles to operate in Seattle. From 2005 to 2019, Seattle additional much more than 169,000 new work opportunities and only about 84,000 new housing units.

Since 2016, Seattle-area home charges have climbed almost 70%. Rents in the metro location rose 23% in five many years. In the meantime, Washington has found a single of the greatest improves in homelessness in the region.

“We need significant commitments to housing manufacturing that to day we just have not produced,” said Colburn, from the UW. “We have to have market-charge, workforce and cost-effective and supportive housing for people today dealing with homelessness. Any one of people in isolation, in my belief, is not ample.”

More Stories

Investment Houses for Sale with High Returns

Houses for Sale Near You Right Now

Beachfront Houses for Sale You’ll Fall in Love With