Household income in the San Antonio location fell in November, but the median cost saved climbing as purchasers observed fewer houses accessible.

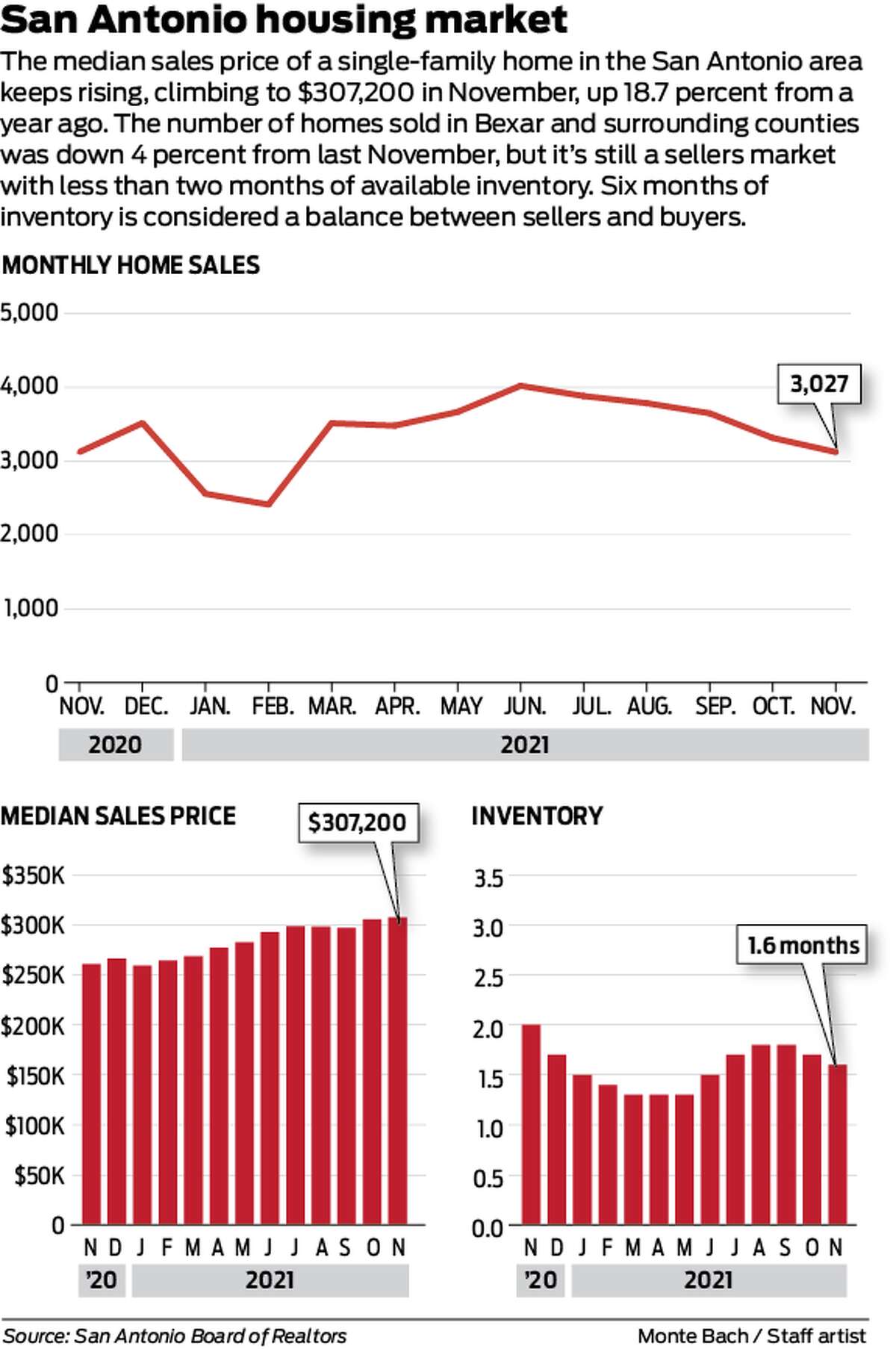

Potential buyers in Bexar and surrounding counties acquired 3,027 houses final month, a 4 percent decline from a 12 months back, according to the San Antonio Board of Realtors.

Spring is generally the fast paced season for gross sales, but pandemic-induced lockdowns and limitations in 2020 pushed that activity later in the year. Gross sales this winter season are coming down from people superior levels.

Even with the revenue slowdown, rates are continue to surging amid powerful demand from customers and a limited provide of homes for sale.

The median residence price soared to $307,200 in November, up 18.7 % from a year previously. It experienced surpassed $300,000 for the initial time in October.

The area’s inventory of obtainable houses declined to 1.6 months, down from 1.7 months in Oct and 2 months in November 2020, but new listings of households for sale had been up 7.5 per cent from a calendar year earlier.

“As we method the close of the 12 months we are commencing to see a look into what the 2022 housing sector could search like,” stated Cher Miculka, SABOR’s board chairman. “A craze we have witnessed is additional new listings hitting the San Antonio industry, which indicates additional stock for future purchasers.”

This graphic exhibits property gross sales in November.

Monte BachApproximately 71 per cent of the houses offered in November were priced in between $200,000 and $499,000, and 16.29 per cent price $500,000 or more. The relaxation marketed for significantly less than $200,000.

About 99.5 % marketed for the outlined value, up from 98.2 percent that did a yr earlier.

Across Texas, 30,415 homes were being marketed in November, up 2.3 per cent from a year earlier. The statewide median selling price jumped 18.5 per cent to $320,000 and inventory dipped to 1.4 months, down from 1.9 months in November 2020.

The National Association of Realtors has not still unveiled figures for U.S. product sales in November. But in Oct, gross sales of current homes nationwide lessened 5.8 p.c from a year previously. Inventory was down 12 % and the median residence value was up 13.1 per cent to $353,900 all through the exact period.

“Home product sales stay resilient, despite lower stock and growing affordability worries,” reported Lawrence Yun, the trade group’s main economist. “Inflationary pressures, this kind of as rapid-soaring rents and increasing buyer selling prices, may well have some future customers looking for the protection of a fixed, steady property finance loan payment.”

Very low mortgage loan premiums have been one particular of the components fueling the incredibly hot housing sector. The U.S. typical for a 30-12 months fixed-charge mortgage was 3.1 percent for the week ending Dec. 9, up from 2.71 p.c a calendar year previously, in accordance to Freddie Mac.

“Mortgage rates have moved sideways about the past a number of weeks, fluctuating within a slender range,” reported Sam Khater, Freddie Mac’s main economist. “Going ahead, the path that fees take will be right impacted by a lot more data about the Omicron variant as it is exposed and the general trajectory of the pandemic. In the meantime, fees remain low and stable, even as the nation faces declining housing affordability and low inventory.”

More Stories

Investment Houses for Sale with High Returns

Houses for Sale Near You Right Now

Beachfront Houses for Sale You’ll Fall in Love With