MANILA, Philippines — Very low-wage earners are into getting genuine estate, as documents of the Household Enhancement Mutual Fund (Pag-IBIG Fund) exhibit that P3.67 billion in loans ended up financed for 8,471 socialized houses in the first half of the year.

Socialized home financial loans accounted for 19 % of the complete 47,184 housing models funded for the period of January to June this 12 months.

In conditions of worth, it represented 7 % of the history P51.96 billion in housing credit score authorized by Pag-IBIG in the 1st semester of 2022.

Pag-IBIG’s Economical Housing Software (AHP) is a special residence funding application exclusively intended for minimum-wage and very low-cash flow associates.

These are members who earn P15,000 a month in Metro Manila and P12,000 for these outside the money.

Low charges, low payment

Pag-IBIG chief govt officer Acmad Rizaldy Moti claimed the program’s small rates and long payment phrases let customers from the minimal-revenue sector to acquire or construct a property of their own.

Underneath the AHP, qualified debtors have a exclusive backed rate of 3 per cent for every annum for housing financial loans of up to P580,000 for socialized subdivision tasks.

This translates to a monthly amortization of as lower as P2,445.30 for a socialized household personal loan.

Standing out as the lowest interest in the bank loan current market, Pag-IBIG very first presented the backed level 5 decades back to aid a lot more users, specially people from the minimum amount-wage sector, personal their possess residences.

Pag-IBIG managed to keep the 3-p.c fee regular owing to the program’s tax exempt standing below the Pag-IBIG Fund Law of 2009.

More Stories

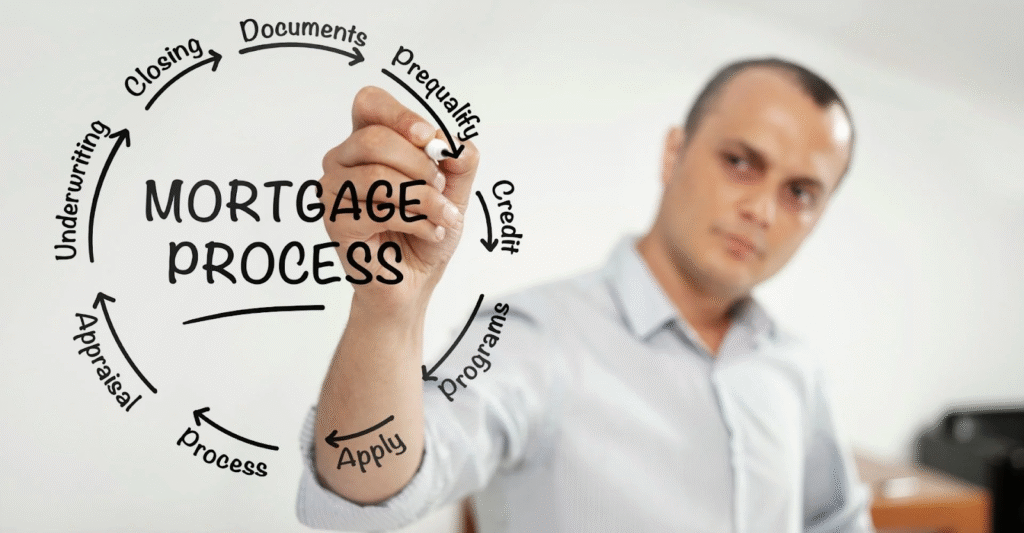

House Loan Prepayment Tips to Reduce Interest

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need