(NEXSTAR) – For 15 decades, a federal program has existed with the intention of supplying public staff like instructors, law enforcement, and those people functioning for non-profit corporations with pupil loan forgiveness. Nevertheless the over-all acceptance score for candidates has been very low.

Lawmakers are now hoping to modify the program’s usefulness with a new monthly bill.

The Community Assistance Personal loan Forgiveness system, or PSLF, was designed in 2007 to aid specific personnel by forgiving their pupil loans after 120 payments more than 10 decades. The amount of candidates in fact acquiring their financial loans forgiven has been low: Just 1 in 5 of the 1.3 million borrowers pursuing credit card debt discharge as a result of PSLF are on track to see reduction by 2026, in accordance to a September report by the College student Borrower Security Centre.

In 2021, the U.S. Department of Training announced a modify that briefly waives particular PSLF requirements to grant debtors credit toward bank loan cancellation no matter of their federal financial loan form or if they had been enrolled in a precise payment prepare, as lengthy as they consolidated their credit card debt into a Immediate Loan right before the stop of the waiver.

Prior to the waiver, borrowers desired to have a precise federal personal loan — a Immediate Bank loan — to qualify for PSLF. Borrowers could consolidate their financial debt into Immediate Financial loans for PSLF, but any payments created on the loans just before consolidation did not count towards the expected tally.

This waiver is at this time set to expire soon after October 31, 2022, that means eligible debtors have fewer than four months to implement. Richard Cordray, the head of Federal Scholar Support, said at a meeting earlier this calendar year that though he is pushing for the PSLF waiver to be extended, President Biden could lack the executive authority to approve such a go.

As a substitute, some lawmakers hope to make the temporary alterations introduced on by the waiver long lasting when enacting further reforms to the software “to permanently deal with the issues of PSLF applicants.”

In a lately released invoice, dubbed the ‘Simplifying and Strengthening PSLF Act,’ Rep. Joe Courtney (D-Conn.) proposes cutting the quantity of time it requires to get relief in 50 percent by lessening the selection of payments necessary to qualify for PSLF aid from 120 around 10 decades to 60 in excess of 5 a long time for borrowers doing work with an suitable employer.

If enacted, the monthly bill would involve any previous payments designed on the borrower’s financial loans — irrespective of the form of financial loan, their payment system, or if payments have been manufactured in comprehensive or on time — toward the required payments for PSLF aid. These suggestions are largely now in area under the short-term waiver set to expire in tumble.

Courtney’s monthly bill would also broaden PSLF access for lively-responsibility navy and Peace Corp volunteers who experienced their loans put in deferment when they had been serving. Currently, specific financial loan deferments are not eligible for PSLF reduction.

On top of that, underneath Courtney’s invoice, parents with Moreover financial loans — in any other case regarded as Guardian Mortgage for Undergraduate College students — or couples who joint-consolidated their loans into a Federal Spouse and children Training Personal loan, or FFEL, would be permitted to re-consolidated their financial loans into a Direct Mortgage, which would then be suitable for PSLF.

As of Thursday, the bill has been referred to the Household Committee on Education and Labor.

Before this thirty day period, the Biden administration proposed sweeping variations to the federal pupil loan system, which include a permanent transform to PSLF that would allow for much more payments to qualify for the method, like partial, lump-sum and late payments. It also would allow for unique sorts of deferments and forbearances to count towards PSLF, and it would make a formal reconsideration procedure for candidates who had been denied entry to the application.

Brad Dress contributed to this report.

More Stories

House Loan Prepayment Tips to Reduce Interest

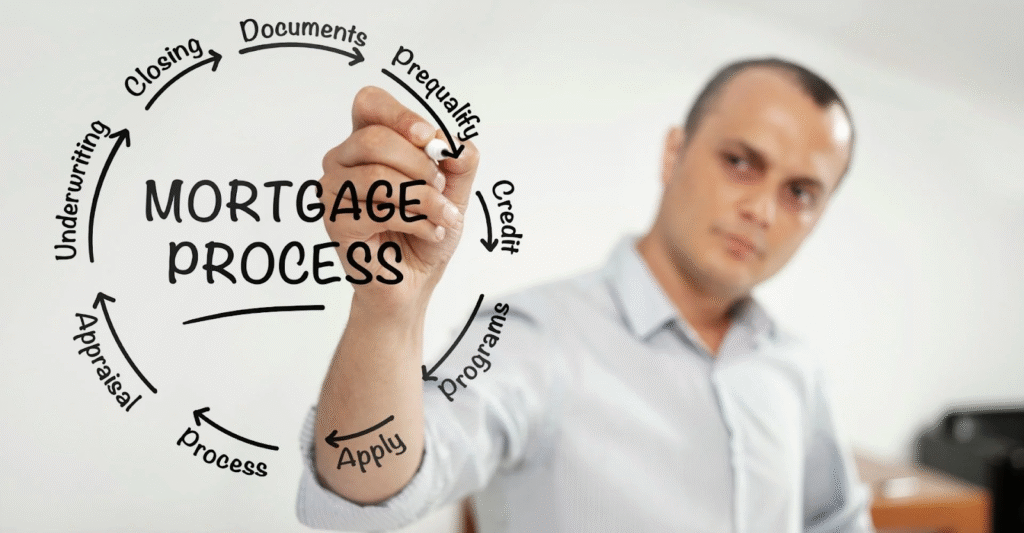

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need