According to a study by the credit bureau, Experian, the average millennial carries about $38,877 in student loan debt. But as we get older, more and more millennials are paying off their student loans for good, and their stories are really interesting.

Similar to millennials’ home-buying stories, I don’t share these stories in a “if they did it, what’s your excuse?” kind of way. First of all, I don’t know your life! Making assumptions about how you should or shouldn’t pay off a multi-thousand-dollar debt would be both rude and ridiculous.

Instead, I think these stories are important because they reveal how actual people are dealing with starting their adult lives already in a financial hole. Some people benefit from luck and privilege, others work hard and budget harder, and for many people, it’s a combo of the two.

Kameleon007 / Getty Images/iStockphoto

Recently, I asked millennials in the BuzzFeed Community to share how they paid off their student loans, and their responses were really eye-opening. Here are some of the most interesting stories:

1.“Refinance, refinance, refinance. I took out private loans, all in my name. I had terrible interest rates when I first took them out. Once I graduated, I shopped around for the best rates and refinanced. I did so without extending the payback period and lowered the interest rate significantly. Five years later, I refinanced again for an even lower interest rate and did not extend the payment terms.”

“In another five years, I refinanced again. After you’ve successfully paid for a few years, your credit score improves and you can get better rates. This made my required monthly payments even lower, so that I could overpay and get them done faster.”

—Colleen, Connecticut

Nastassia Samal / Getty Images/iStockphoto

2.“Our taxes were garnished three years in a row. We didn’t have a choice to pay them or not at that point.”

3.“Long story short, I graduated college in three years, while working 30 hours per week. I picked a low-cost state school. I am a former straight-A student but I managed with Bs so that I could make it work financially. I also didn’t have a typical college social life and never went on spring break trips or studied abroad. Basically, I was only able to focus on school or work so that I wouldn’t be buried in debt. The benefit is that I’m proud of the skills I’ve learned and keeping this budgeting discipline allowed me to buy a house by age 28.”

—Alessi, Florida

4.“My salary as a first-year teacher at a private school was $30,000 a year (same as my loan at the time I finished school). I lived in a super cheap apartment with a roommate. Drove my old crappy car. Each month I paid two to three times what my monthly student loan payment was.”

“In the summers, I worked three additional jobs. I put all my extra income toward my loans in addition to income from my teaching salary.I worked during college, so when I graduated I already had about $10,000 in savings. Also, I started applying for scholarships in my junior year. I wish I would’ve applied for more sooner.”

—Anonymous

Solstock / Getty Images

5.“I took out $25K for a state school. I always saw the money as someone else’s, so I needed to be careful with it, especially since I couldn’t rely on my parents. I lived in a really, really old apartment with serious water damage smell. My monthly spend was $650: $410 for my share of the rent, $30 for my share of internet, $120 for groceries, $40 for my phone, and $50 for anything else. While my college peers bought new clothes, drank, etc. I worked nearly full-time. I didn’t have Netflix, get a haircut, or buy any makeup for all of college! I didn’t go to a single college party.”

“I graduated in 3 years and made $50K upon graduation. I paid off my loans nine months after graduation by living severely below my means. I had A LOT of fun partying after college. Seven years later, I’m making $180K. I invest and spend wisely, but usually on whatever I want. Looking back, I would be nicer to myself and have less anxiety, but I wouldn’t change my spending habits.“

—Anonymous

6.“I realize that this is coming from a place of privilege but I moved back in with my dad. He didn’t make me pay rent; he fed me and paid all utilities. I worked a full-time job during the week and waitressed on the weekends. I used my tips as gas and spending money and put 100% of my paychecks towards my loans for three straight years. It was excruciating and I had a very limited social life, but that’s how I did it.”

7.“I work for a company that pays 50% of tuition as a benefit and I worked full-time through school. I paid half in cash and loans for the other half. By the time I graduated and student loans came about, there was only about $10,000 left and I paid it.”

8.“My parents are wealthy, so I paid my loans off in full with money they gave me.”

—Anonymous

9.“I was driving on 95 North going to work one day, and the van in front of me veered off to the shoulder where I saw a car coming at me that had lost control. One head-on car accident settlement later, I paid off my student loans.”

“I got an email from Navient a few weeks later asking for my ‘inspiring story’ on how I paid off my student loans. I thought real hard about some snarky response, like, ‘just get hit in a head-on car accident and you’ll be good to go.'”

—Andrew, Connecticut

10.“During the pandemic, my husband offered to pay off my loan with the money we had saved for a house. I make monthly payments back to our joint account (all of our other accounts are separate). It is so much more manageable now. I had been paying for ten years and owed over $36,000 — I started with $27,000. We both decided we didn’t want a house anymore, but it is still so weird we had to make that choice.”

11.“I took a loan from my 401(k) and paid off my school loans. It was a five-year loan and I paid myself interest. Education loans can be a never-ending money pit, but I had an obligation to pay them back. Now I am free and clear with a good conscience.”

—W. Davis, Virginia

12.“With financial aid, work study, and my parents’ yearly payments, I graduated with roughly $40,000 in student loans from a private university. I paid off my loans in 11 years by working both as a full-time teacher during the week and a server/bartender on the weekends. I worked seven days a week for many years. What a relief to make those last payments!”

—Anonymous

13.“I’d been chipping away at my student loans for a few years when my dad was diagnosed with stage 4 cancer. Before he died, he asked my mom to pay off my loans as my inheritance. It’s made conversations about the student loan crisis really painful, as people are always surprised to learn mine are paid off and expect to hear some inspirational story about budgeting or pulling myself up by my own bootstraps… But they get to hear about my dead dad instead.”

14.“I only needed loans for the last year of college thanks to a generous gift from my grandparents. Plus, my wife is a nurse practitioner who makes four times what I did before I left the workforce to be a stay-at-home dad, so her career has paid for both of our remaining loans.”

15.“I graduated with $23K in debt. But I would have had closer to $53K if my parents hadn’t been willing to apply for a parent loan to help me. I paid $100 more than my mandatory monthly payment each month and put my tax refunds toward my balance. This helped me pay my loans back in seven years instead of the standard 10. I don’t know how people without any help from family or forgiveness programs do it.”

—Mackenzie, North Carolina

16.“A few years after college while working two jobs, I was able to purchase a fairly new duplex using a USDA loan program that allowed for a 0% down payment. I sold it after a few years for a decent profit (even after surviving a costly divorce). I then bought a larger home and lived in it for a couple years and started a family. I sold it last year during this wild housing price boom and made enough to pay off my student loans and put money down on a 5,000 square foot dream house with plenty of land. Life is good!”

17.“I had almost $100K in debt after four and a half years of undergrad and three years of law school. I worked a bit while I studied, but I was determined to be debt free afterward. I had NO help with any of it, but I made it a priority to pay it off. I lived in a crappy studio condo for years, didn’t buy a car, was frugal with purchases, etc. In less than 10 years it was paid off. I don’t have a huge lawyer salary either — I work in public service.”

18.“My loan debt was pretty astronomical, but luckily I got a good paying job with a six figure salary, right? Sort of. My interest rates were so high, my loan payments were an entire half of my total monthly expenses and my principle never seemed to go down much — even trying to pay above minimum payments.”

“Luckily, my grandparents were well off and offered to buy my loans, which I could pay back at 0% interest. I threw everything I could at them and after five years I was loan free. My situation is so, so, so rare and lucky. Otherwise, I would still be paying them for another 20 years. Love you, gramps and grams.”

—Anonymous

19.“I didn’t have my own place until I was 28. I lived with parents, grandparents, and as an au pair. But every dollar that would have gone to housing went to my student loans. It’s not for everyone, but the interest rates were criminal, and I knew paying them off had to be my top priority in order to move on to my next chapter in life.”

20.“I got my undergrad degree in 2003, before tuition prices really shot up — that’s a lot of it, just being in college at the right time in history. Between a partial scholarship and a grant, my loan was pretty small and I was able to pay it off within a couple of years.”

“My *graduate* school loans, on the other hand… I can afford the payments, but they’ll be with me for a long, long while.”

21.“I had $72,000 in loans upon graduation. I sat down with my parents who had their house paid off, and they used it as collateral for a home equity loan. This lowered the interest rate to I believe 3%. I then made payments and my parents committed to pay half the loan. I lived with a roommate for five years to save on rent (sacrifices) bought a low cost fuel efficient car, nothing flashy.”

“I was able to start making large payments on the loan and paid it off in year five. It really was about making sacrifices to pay off. No huge trips, no new car, couldn’t buy a home. You make do with what you can and use the resources around you. I was lucky my parents were willing to help, but all it took was a conversation explaining it.”

—Anonymous

22.“A lot of people talk about side hustles, but the pandemic provided me with the opportunity to work two jobs remotely and finally pay off my loans. Was I exhausted for a year? Yes. Do I sometimes get teary-eyed thinking about what I could’ve done if I had put that money elsewhere? For sure. But businesses that require college and then pay you nothing are not your friend, so no regrets about being shady with my jobs.”

23.“I was able to buy a home in 2016 and refinance in the summer of 2021, just when interest rates were at their lowest. This allowed me to take the cash from my refinance and pay off my student loans, as well as finish my basement. I never thought it would be possible!”

—Michelle, Delaware

24.“I got hit by a Mac truck when I was 12. The accident itself should have killed me and my mom on the spot; the injuries I sustained weren’t even caught until I was within hours of dying, and repairing that injury caused damage that required ANOTHER surgery six years later. The accident was 1,000% not our fault, so we settled in mediation.”

“Because my injuries were (1) more severe and (2) would likely cause increased difficulty with age, my payout was larger. My mom brilliantly had my payout put into a court-ordered structured annuity, and she scheduled the payouts to fit with the career I wanted to pursue at the time.

Then inflation happened and my dreams changed; while the payouts weren’t enough to keep me completely loan and debt-free, they DID allow me to pay for more than half of my tuition each year and made it easier for me to pay off what loans I had less than five years out of college. I NEVER would have gone to the college I did without that accident.“

25.And finally, “I graduated with about $25K of student loan debt and have taken jobs in government since. I took a break after my second year of college to get an entry-level job and then finished going part-time so I could minimize the number of additional loans. 15 years later, I just paid off my last undergrad loan by doing Income Based Repayment, minimum retirement contributions, and putting every tax return toward the loan. Technically, I should have qualified for the Public Service Student Loan Forgiveness five years and $10K ago but we all know how that went…”

“I honestly think my saving grace is that my spouse is in the military and DIDN’T go to school. We would still be knee deep if he had had loans as well. It’s absurd that in four years my child will be going to college, and I just paid my loans off.”

—AL, California

Maskot / Getty Images/Maskot

Are you paying off student loans? Tell us about your debt journey in the comments.

And for more stories about work and money, like the things you can do right now to get a big, fat tax refund next year, check out the rest of our personal finance posts.

More Stories

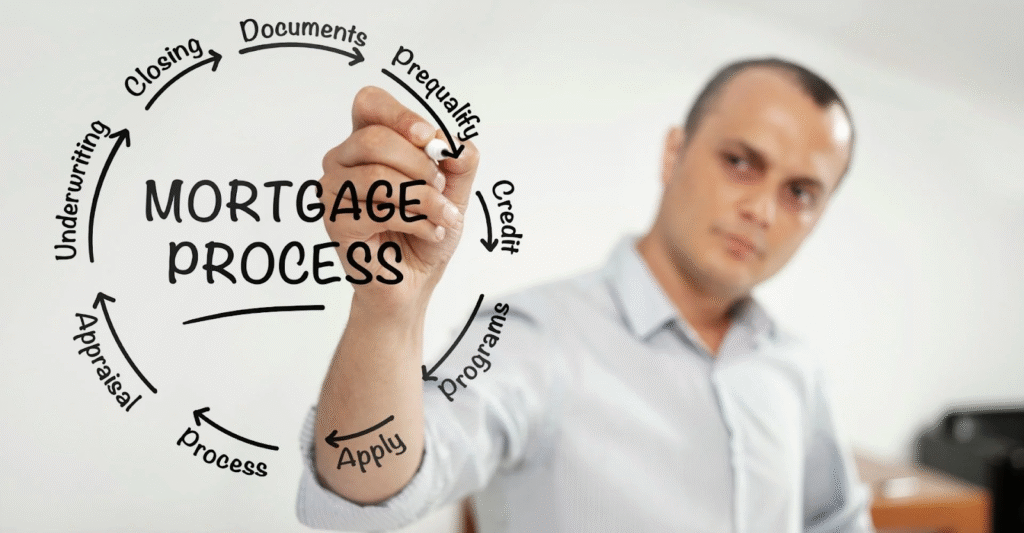

House Loan Prepayment Tips to Reduce Interest

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need