When Moraima and Roland Duran researched what kind of property to develop on their three-acre ton north of Austin, Texas, the couple was pleasantly shocked by the range of decisions provided by a new era of produced properties.

The Durans once lived in a smaller trailer on their lot. They discovered today’s prefab solutions far additional interesting: The few was capable to personalize a 2,100-sq.-foot design to include things like fireplaces, a area for their puppies and entrance and back porches.

“The high-quality of the households from several years earlier experienced truly upgraded,” Moraima Duran suggests.

For the reason that their produced house fulfilled the similar setting up standards as a web page-designed residence, they were able to finance the invest in with a Federal Housing Administration mortgage loan.

Amid a historic housing boom, 1 that’s pushing homeownership out of attain of numerous Us citizens, manufactured housing provides a partial alternative to the affordability squeeze. Makers of created properties have elevated their video game in new a long time, and mortgage giants Fannie Mae and Freddie Mac have responded by backing home loans on bigger-finish prefab properties.

“When you seem at the excellent of our development, some folks think that we’re conversing about grandma’s trailer, and which is plainly not what we are producing these days,” claims Lesli Gooch, executive director of the Produced Housing Institute, an field trade group.

Prefab properties are no treatment-all for the housing lack – a lot of municipalities really do not make it possible for produced residences, funding can be tricky and buyer perceptions about previous-school one-extensive trailers die challenging. But proponents of created housing say the house style provides at least some relief to the nationwide shortage of homes.

A much less expensive way to develop a home

The Durans acquired a model from Clayton Properties that began at a base cost of $198,000. Soon after introducing options, the selling price ballooned to $300,000.

The Durans in their kitchen.

Meghan Francis/Courtesy of Clayton Households

Even so, created housing is considerably less expensive than web page-built building. The normal price tag for every square foot for made properties in 2021 was $57 per square foot, properly underneath the $119 common for common houses (a determine that excludes land fees), according to the Made Housing Institute.

The discounts occur due to the fact, as opposed with painstakingly constructing a property on a vacant large amount, it’s much more economical to establish a house in a factory and then immediately assemble it on web page. Regular houses are built from the ground up by teams of subcontractors, and work unfolds around the training course of months.

Created households, by contrast, are constructed in factories and then delivered by truck to the homeowner’s whole lot and assembled in hrs. The a lot quicker method cuts charges by increasing performance and speeding building timelines.

“Manufactured housing features significant cost price savings around traditional adhere-crafted houses in spots the place land expenses are comparatively lower, due to the fact it reduces the construction labor and supplies fees,” writes Jenny Schuetz, a fellow at the Metropolitan Policy Program at Brookings, in her new ebook, Fixer-Higher: How to Mend America’s Damaged Housing Devices. “This would be specially practical in rural locations or metropolitan areas with a higher incidence of vacant tons, this sort of as Detroit or Baltimore.”

Land prices matter for the reason that the price of dust is potentially the most important element driving regional dissimilarities in home costs. The median price tag of a solitary-family home in San Jose, California, was $1.65 million in the 3rd quarter of 2021, the Countrywide Affiliation of Realtors suggests. In St. Louis, the median dwelling price tag was $235,700. It doesn’t cost $1.4 million additional to establish a dwelling in San Jose it’s just that land is so a great deal much more high priced. So produced houses are not likely to make a dent in the affordability squeeze in the most highly-priced marketplaces.

Worries remain

Despite the charge rewards, created residences continue being an overlooked and unloved corner of the housing marketplace. A lot more than 21 million Individuals are living in produced homes, the Made Housing Institute estimates, but the residence form stays saddled with stereotypes.

“One of the problems we are having is the stigma around our households,” Gooch states. “When men and women hear manufactured household, they think of cell household. They consider of trailer. They’re not considering of the style of houses we’re making nowadays. We need to have to defeat that perception that individuals have.”

People damaging impressions are deeply rooted. A lot of consumers, serious estate brokers, loan providers, appraisers and housing economists associate produced housing, to one particular diploma or a different, with minimal-benefit homes in undesirable places, a recipe for depreciation alternatively than appreciation.

Safety fears are yet another concern – the Durans’ prolonged-ago trailer burned down back again in the 1990s. And early generations of mobile households lacked the weather conditions resistance of today’s hardier versions.

Made homes gain momentum

In a new surge of focus, the affordability crunch has centered new notice on manufacturing unit-built residences. Gooch, head of the Manufactured Housing Institute, resolved members of the Countrywide Affiliation of Realtors, the nation’s greatest trade team, in a webinar.

And the Lincoln Institute of Land Coverage in January urged Fannie and Freddie to finance more made houses as a way to help additional People in america pay for houses. The suggestion arrived in part simply because makers of manufactured households are building bigger-excellent products and solutions, claims Jim Grey, senior fellow at the Lincoln Institute.

“In the final couple of many years, the marketplace has shifted toward setting up houses that are indistinguishable from web-site-designed homes,” Gray says.

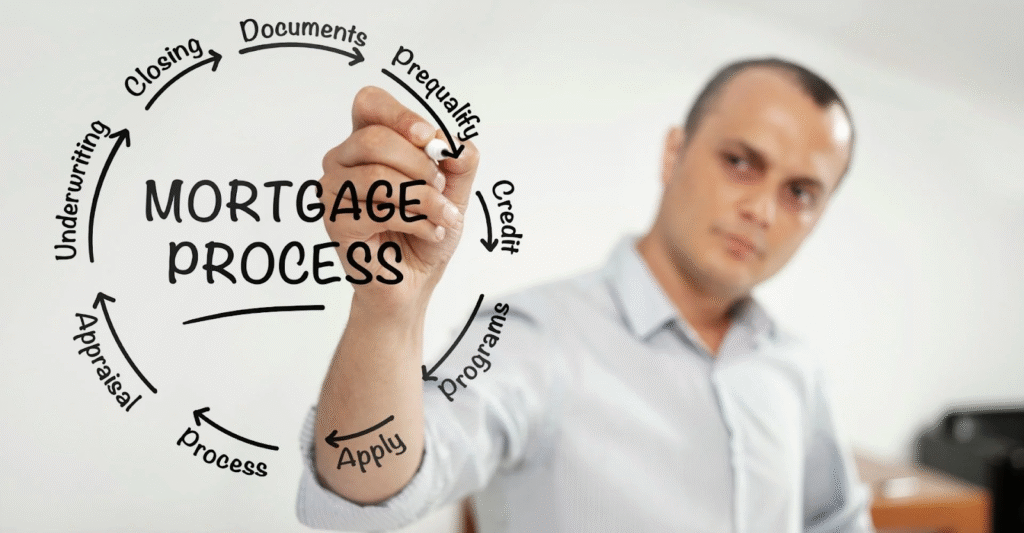

How to finance a made dwelling

Having a regular house loan on an old-type mobile household is approximately unattainable. That is due to the fact quite a few of the homes are situated on loads that inhabitants lease fairly than possess. Home loans frequently are not out there in that situation, leaving householders to just take “chattel loans” somewhat than classic residence loans.

Having said that, the new generation of made homes – identified in the field as “CrossMod” residences – are qualified for mainstream mortgages. That’s since the newer households are constructed to keep in one particular area and to fulfill the exact same safety standards as web site-constructed residences, and because owners generally own the plenty beneath the properties.

This new breed of produced housing is eligible for a property finance loan by means of Freddie Mac’s CHOICEHome program and as a result of Fannie Mae’s MH Gain initiative. The Federal Housing Administration and the U.S. Section of Veterans Affairs also would make financial loans on better-conclude made houses, so prolonged as the borrower owns the land.

How to acquire a manufactured home

- Come across a location. Site range is the first action. Make a decision no matter if you will hire or individual the land. Hold in brain that leasing the good deal gives you much less funding alternatives. If you acquire a good deal in a produced home community, you can feel confident that the housing kind is allowable less than regional zoning codes. If you are wanting at land outdoors a local community of prefab houses, make positive nearby policies make it possible for created homes.

- Store for a created residence. Look at the assortment of made properties offered. The process can be comparable to selecting out a web page-developed new property or even a new automobile – you can go with the off-the-shelf product, or you can customize it to match your wants.

- Lock in a bank loan. Now it is time to obtain a personal loan. If you have the land and you are investing in a person of the larger-close new mobile homes, you need to be qualified for a house loan as a result of Fannie, Freddie, the FHA or the VA. Look at with lenders, a home finance loan broker or the organization selling your created household to see which form of loan ideal matches your circumstance

- Put together the lot. The maker of your residence will work with you to make absolutely sure the filth less than your residence is completely ready to go. This incorporates these kinds of measures as implementing for permits and making ready utility connections.

- Agenda shipping and installation of your home. The moment the funding is lined up and the lot is ready, the producer of your dwelling will deliver and set up the household.

Master additional:

More Stories

House Loan Prepayment Tips to Reduce Interest

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need