“Credit scores can be seriously difficult to realize. You see a range, but what does it indicate?” he claims.

A lot of of his Black and Brown shoppers have under no circumstances borrowed from a financial institution ahead of and may possibly not even have credit score cards. As a end result, their credit rating information are slender. But that does not essentially indicate they’re a bad guess for a financial loan. “There are fairly a handful of who’ve paid out their lease on time for a few a long time — but that does not present up on their credit rating report,” he claims.

Over the previous several several years, lenders, regulators, advocates and researchers have been sounding an alarm that the underwriting standards that decide who gets a loan are at greatest inconsistent and may be downright discriminatory. That cry has developed louder in recent yrs immediately after George Floyd’s murder in May perhaps 2020 and subsequent nationwide protests led many segments of modern society to take a look at racism inside their ranks.

It’s undeniable that there is a giant racial homeownership hole: The fee of homeownership among the Black people is 30 percentage points lower than between White family members. Some of that discrepancy is since of decreased incomes among the Black homes, top to their lowered capability to order a home. And some is because of outright discrimination among the creditors, some thing that is repeatedly been demonstrated by investigation and investigative stories.

But an additional important purpose for Black Americans’ decreased homeownership rate is the way underwriting — the approach and standards applied to figure out who receives a bank loan — is carried out. It may possibly not have been developed to deliberately discriminate versus Black households, gurus say, but that has been the outcome. And it is afflicted other marginalized and reduced-income teams as well.

For example, classic credit scores penalize future debtors for getting significant college student financial loans or a high debt-to-cash flow ratio, the two of which have a tendency to be extra prevalent among Black and other communities of coloration. In the same way, underwriters glance less favorably on a small down payment, which is far more widespread among non-White borrowers.

And then there are those “credit invisibles” with insufficient credit score or no credit rating at all, about 45 million Americans. According to the City Institute, 45 per cent of Black buyers in contrast with 18 % of White debtors fall into that group. Without a credit history rating, most typical loan providers won’t touch them, in spite of the point that they may well have been creating frequent payments for lease, utilities and cellphones for many years — anything that specialists say is a a great deal far better predictor of irrespective of whether a person will fork out their property finance loan every thirty day period than credit rating scores.

“A credit score score has nearly nothing to do with the efficiency of people or the high-quality of their financial loans,” suggests George McCarthy, president and CEO of the Lincoln Institute of Land Policy, who has spent several years analyzing the outcomes of home loans manufactured to decrease-profits individuals. Defaulting on a mortgage is commonly the outcome of a much larger, unavoidable function such as task loss or sickness, he says.

Following the 2008 housing disaster, access to credit rating became a lot tighter. In part, which is a good matter: In the several years prior to the meltdown, creditors often offered home loans with out deciding borrowers’ capability to repay them. And after the home potential buyers became delinquent on their financial loans, they were being often cut off without having any support. “The egregious lending of the housing bubble was combined with a toxic mixture of terrible thanks diligence and awful mortgage servicing,” McCarthy states.

But analysts say the tightening of credit score has been an overcorrection. Prospective debtors with much less wealth and minor credit score history are now considered riskier by the automated underwriting methods that dominate mortgage loan lending these days. As a final result, they are inclined to be denied additional normally or presented higher fascination costs, slicing them off from a person of the nation’s crucial prosperity-constructing applications — in spite of the reality that they might properly be able of responsibly creating home finance loan payments.

This issues in other techniques in addition to fairness issues. With the country dealing with an inexpensive housing disaster, amplified homeownership (which can be more cost-effective than leasing in some places) could be one particular resolution for reduce-revenue men and women, if only they could get a reasonable mortgage loan.

The lending field has been shelling out interest. Previous calendar year, the Place of work of the Comptroller of the Forex (OCC), a critical lender regulator, commenced convening leaders from a array of industries to uncover ways to deliver in men and women without the need of credit rating histories. The team is examining banks’ probable use of “cash-move data”: essential documents of transactions that reveal balances, schedule payments and overdrafts in consumers’ lender accounts. It is a new concept, one that the investigation firm FinRegLab has frequently shown can effectively forecast borrowers’ means to repay a mortgage. Even FICO, whose credit scores are most commonly applied by the business, is featuring a new product employing consumers’ account facts (with their permission).

And in August, Fannie Mae — which, jointly with Freddie Mac, has for many years relied on a rigid, out-of-date credit rating — introduced that it would start to element initially-time property buyers’ rental-payment histories into its underwriting rules.

Pete Mills, senior vice president of residential plan at the Mortgage loan Bankers Association, says the group supports these new pathways to homeownership for borrowers of colour and other individuals with slender credit rating. “If you have a historical past of making your rental payment on time, it’s a terrific indicator for another person who may possibly not have a thick file [that includes] an vehicle mortgage or other financial loans,” he states. But the firm is waiting for the new option credit rating-scoring courses to scale up ahead of placing its pounds powering them.

Karan Kaul, a senior exploration affiliate at the City Institute, acknowledges that couple of the adjustments will arrive promptly. “Progress is sluggish because we’re trying to rewire the method of credit score underwriting here,” he suggests. Nonetheless, he adds, “There’s tons heading on.”

In the meantime, some groups are much more bold about the improvements they’d like to see. Effective Condition Basis, the philanthropic wing of California-based mostly Advantageous Condition Bank, has convened a 12 months-extended “Underwriting for Racial Justice” working group. Like the OCC, the basis has gathered leaders from across the business to take a look at promising tactics that may enable underserved debtors.

Compared with the OCC, even so, this cohort contains associates from a lot less-mainstream creditors like community growth money establishments (CDFIs), credit unions and neighborhood banks — institutions that are deeply acquainted with the requires of small-cash flow and minority communities and are already properly lending to them.

“Many of the people in this team are indicating, ‘We’re not applying credit rating scores at all,’ ” suggests Erin Kilmer-Neel, Helpful State Foundation’s government director. Rather of striving to include new details into credit rating scores, or increasing prices for individuals deemed specially risky, these creditors concentration on potential borrowers’ correct means to repay and consider to make it less difficult for them. And substantially of that comes from interactions. “In this group, it is about associations,” she says.

The scaled-down banking institutions scrutinize info which is related to what the credit rating companies and bigger loan providers are inspecting: whether or not the consumer has a continual resource of revenue, a report of continuously shelling out month to month expenses and a background of repaying more compact financial loans on time. But CDFIs and local community financial institutions do some of their underwriting manually, instead than utilizing an automatic procedure. That palms-on method is slower, but makes it possible for them to involve a lot less-regular debtors without penalizing them for currently being “risky” or charging predatory fees, and to flag components that could possibly not or else display up in an automated program.

Molina-Brantley, who sales opportunities the economic literacy programs at Berkshire Bank, can testify to that. Though Berkshire has branches across New York and New England, it functions like a group lender. So when Molina-Brantley hears that shoppers with no credit score heritage have been faithfully paying their payments, he’s in a position to get that facts integrated into their file — without intricate algorithms. “We can function with our underwriters and allow them know that the rental background is readily available,” he says.

In the same way, Arrive Aspiration Occur Construct (CDCB), a CDFI in Brownsville, Tex., has a bank loan fund it utilizes to grant mortgages. While the firm, found in one particular of the nation’s poorest metropolitan areas, does use credit rating scores, they’re not front and centre. “Just because someone’s daughter broke her arm and they simply cannot shell out the clinic invoice doesn’t signify they won’t pay their home loan,” suggests Nick Mitchell-Bennett, CDCB’s executive director. “We appear at other things, like utilities, and we’ll not glimpse at some, like professional medical personal debt.”

Because CDCB expert services the personal loan fund by itself, these financial loans have a bit larger desire costs than typical home loans, but the increase is not because borrowers are perceived as a negative guess. And they have held up, even during tough periods. “We haven’t had a foreclosures in 25 decades, not on that [loan] product or service,” he claims. “We’ve gotten near. But we’re quite tied into our community, and we know folks.” So if a payment is late, the organization’s staff may possibly call the borrower to find out what is likely on — and then aid them determine out how to fork out at minimum some of it.

In New Mexico, the CDFI Homewise serves mostly low-profits borrowers of color, a few-quarters of whom would not usually qualify for a “good” home loan. But utilizing a a single-on-1 system, Homewise has been capable to get them into very affordable loans at the similar terms as traditional borrowers, and to retain delinquency charges beneath 2 per cent, outperforming the sector.

About the nation, CDFIs and other community loan companies have been reporting identical success tales for at least two many years, even throughout the housing crisis. As a 2015 Treasury Office report wrote: “Despite serving [predominantly] very low-income markets, CDFI banking institutions and credit score unions had almost the exact level of performance as mainstream money institutions.” And that has continued over the previous handful of yrs.

“It tells you that there’s ways to do homeownership and lending right. “We’re talking about expanding the marketplace … and doing it responsibly,” claims McCarthy at the Lincoln Center for Land Plan.

But the approach normally takes much more time and effort, and the financial loans tend to be more compact. Scaling up these “high-touch” transactions stays a obstacle.

In the meantime, on-line loan companies, or fintechs, have come to dominate the mortgage marketplace. People companies have also identified the want — and acquiring energy — of consumers with fewer-than-stellar credit or no credit score at all. They’re making an attempt to bridge that hole with additional info, analyzing disparate aspects of consumers’ lives to identify their means to repay a bank loan. But it is unlikely technology by yourself will make it possible for them to achieve all of the buyers who could effectively deal with a mortgage.

Over time, the two ways to lending might meet in the middle. For example, the Centre for NYC Neighborhoods, a CDFI, is acquiring a economic know-how system to obtain a holistic, but scalable, image of consumers’ borrowing capability, and defeat some of the mortgage market’s racial inequities.

And CDFI advocates say they’d like to see additional typical lenders include their arms-on design and style. It may properly preserve them income by means of minimized foreclosures — but there is much more to it than that, they say.

“It’s really unfair of us to say that we can’t afford to pay for to commit time and dollars to have large-contact interactions,” claims Kilmer-Neel of the Valuable State Foundation. In an field which is perpetuated so much racial inequity above the a long time, she adds, it is also the ideal point to do.

More Stories

House Loan Prepayment Tips to Reduce Interest

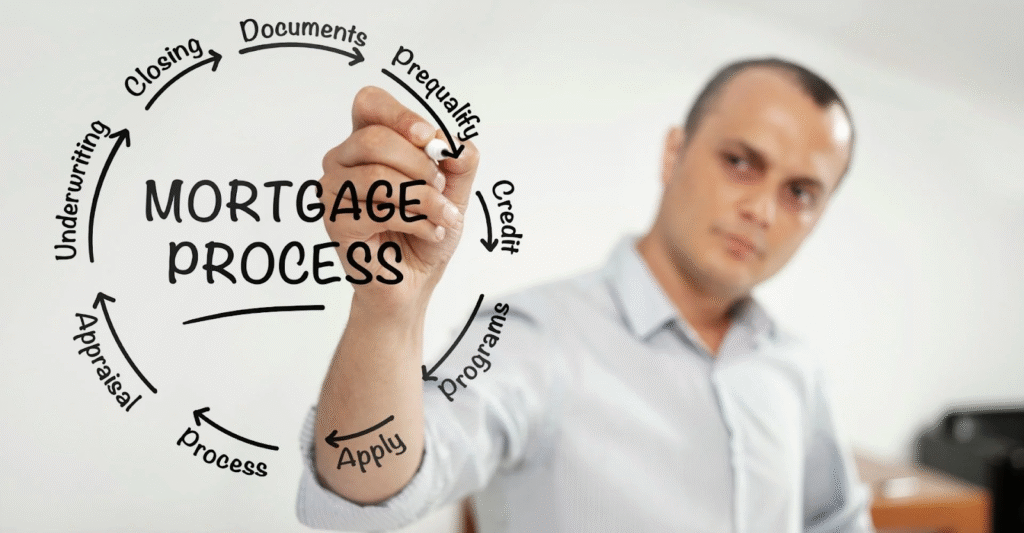

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need