Buying a house can be stressful enough for seasoned buyers, let alone first-timers. Do I have enough saved for a down payment? Will I qualify for a mortgage? Will I get a good interest rate? These are just some of the questions that might run through your mind when you’re getting ready to buy your first home.

We’re here to make the process easier. The following steps will put you on the path toward homeownership and hopefully ease some of the stress.

Steps for Buying a House for the First Time

Prepare your finances

A house is likely to be the biggest purchase you’ll ever make. You should be confident that you are financially ready to buy before jumping into the market. Start preparing your finances at least a year before officially starting your home search.

Check your credit score and credit report

One of the most important pieces of information your mortgage lender will look at is your credit score. Borrowers with excellent credit will usually qualify for the lowest interest rates and more affordable monthly payments.

Your credit score is based on your credit report. You can request a free copy of your report from each of the credit reporting bureaus at Annualcreditreport.com. Look for negative and incorrect information that could be lowering your credit rating and then work on other ways to improve your score.

Start saving for a down payment early

Buying a home requires cash. Start saving as soon as you know you want to become a homeowner. In surveys more than half of potential buyers say not having enough for a down payment is the biggest barrier to homeownership.

While 20% is the ideal down payment amount (because it eliminates the need to pay for private mortgage insurance) most people don’t save that much, and it’s rarely required. Conventional loans, for instance, require a down payment of only 3%.

You’ll also need to cover closing costs, such as origination, appraisal and inspection fees, as well as attorney fees. Fees can total between 3% and 6% of the loan amount. Figure out how much you can comfortably set aside each month and automatically deposit that amount into a designated savings account.

Determine How Much Home You Can Afford

Next, it’s time to figure how much house you can afford — and how much you actually want to spend. Start these steps at least six months before starting your search.

Find out how much you can borrow

Lenders will look at your credit score, down payment and debt-to-income ratio — which measures how much of your monthly income goes towards paying debts — to determine how much money they’re willing to give you. The easiest way to estimate this number is with a home affordability calculator. Consider this the upper limit of what you can spend on a home.

Settle on a budget

Just because you can qualify for a large mortgage, doesn’t mean you need to spend that much. If spending that much would get in the way of other goals or upcoming expenses, spend less.

Also consider how competitive the local housing market is. Over the past few years, many homebuyers have had to make above asking price offers in order to secure the home they want. If this is the case in your market, it may make sense to focus on houses that cost less than your overall budget. That way you’ll have room to negotiate in a bidding war.

Don’t forget to factor in repairs, new furniture and moving costs

The costs of buying a home go beyond the mortgage payments and closing costs. Many homes will require repairs before you can move in. New homeowners spend about $27,000 to get the average home in move-in ready condition. You may also need to buy new furniture or use a professional moving service. All of these should be factored into your home buying budget.

Even newly built homes require routine maintenance. You should set aside a separate budget for home upkeep projects. Save between 1% and 4% of the home’s value in a repair fund to keep your home in good condition for years to come.

Secure funding

Now it’s time to set your plan in motion. You should start the funding process two to four months from the date you ideally want to purchase a home.

Season your assets

Mortgage lenders like to see money that’s been in a savings account for at least 60 days before you apply for a loan. This is called seasoning your assets, and it tells potential lenders that you have enough money to cover the costs involved in a home purchase.

If you’re planning on using money from investment accounts for a down payment or are relying on selling an asset or receiving a gift from a friend or relative, make sure you access those funds ahead of time.

Look into funding, grants and loan assistance programs

If you’re having trouble gathering enough for a down payment, look into first-time homebuyer programs. These are typically offered by state and local governments and are primarily designed for first-time buyers interested in purchasing a primary residence. Each program will have its own credit and income requirements, so make sure to check all the options in your area.

Shop multiple lenders

When it comes time to apply for a home loan, it pays to shop around. The best mortgage lender will be the one that offers you a competitive interest rate and closing costs, as well as terms that fit your needs. You want to look at different types of loans, such as conventional or Federal Housing Administration-backed loans, to see which best suits your situation.

While borrowers tend to focus on the annual percentage rate (APR) offered by the lender, there are other factors to consider. Compare closing costs, late fees, whether there are any prepayment penalties or other fees. Sometimes the lowest interest rate offered may not be the best option.

Since every lender will offer a different rate, shopping around can save you money. According to Freddie Mac, borrowers can save up to $1,500 over the life of the loan if they get one additional rate quote and up to $3,000 if they get five additional quotes.

Get preapproved for a mortgage

Once you’ve found a lender that you’re comfortable with, get a mortgage preapproval. This is a letter certifying that your lender has thoroughly looked at your finances and — if your financial situation remains the same — will lend you up to a certain amount for a home purchase. A preapproval also tells home sellers that you are serious about buying and that the deal is unlikely to fall through.

Preapprovals usually expire after 60 to 90 days. Make sure to ask your lender how long their letter will last and whether it can be extended if necessary.

Find and buy the right home

Now that you have your financing in place, the fun starts. It’s time to go house-hunting! On average, this phase takes two months, but there is a lot of variation.

Scout neighborhoods early

Explore different neighborhoods ahead of time, both in real life and on listing websites. This has two advantages: it will give you an idea of home prices and also lets you gauge commute times, traffic patterns and proximity to schools, parks, shops and other amenities. Even if you are focused on a single neighborhood, shop around other areas. You may find a hidden gem in a neighborhood you don’t expect.

You also want to start homing in on which home features are most important to you and where you’re willing to compromise. The clearer idea you have of what you want, the less likely you’ll waste time looking at unsuitable homes (or end up with a home you hate).

Hire a real estate agent

Look for a real estate agent that is experienced in the neighborhoods you’re eyeing. They’ll know how competitive the market is and whether a home is well priced. They’ll also be able to point out potential defects in a home or items that may need repair or replacement.

A good agent will alert you to potential homes, sometimes before they officially hit the market. Interview at least three different agents before committing to one and make sure you are comfortable working with them. Ask for referrals from friends and family.

Your agent will earn a commission when you buy, which can range between 3% and 6% of the purchase price of the home split between your agent and the listing agent. Typically the seller is responsible for paying this commission for both agents.

In some places the agent you hire technically represents the house. Consider hiring what’s known as a buyer’s agent who will be obligated to represent your interests and work to get you the best deal.

Make an offer

Once you find the right house, you need to make an offer. Your real estate agent will help you with this, but items you’ll need to decide include: how much are you offering for the home? How much earnest money (an initial deposit on the property which is later added to the down payment) you’ll pay? What concessions do you want from the seller? How long are you willing to wait to close and move-in?

Your real estate agent will present it to the owner, who will either accept it, reject it or make a counteroffer. If your offer isn’t accepted at first, you can put in another bid.

Agree on contingencies

Contingencies are stipulations in your offer that will allow you to walk away from the purchase under specific conditions. Examples include the home purchase depending on the buyer getting approved for a mortgage, the seller being responsible for certain repairs or for closing costs, or the home passing a home inspection.

Put your contingencies in writing as part of your offer and make sure the ones you agree on appear in the sale contract. If the sale falls through because the home or seller didn’t meet a contingency, you can get your earnest money back.

Request a home inspection

Home inspections are designed to evaluate the structural integrity of the home as well as the plumbing, electrical and heating/cooling systems. An inspector will determine if there are any issues that either require major repairs or make the home unsafe.

As the homebuyer, you will be responsible for paying for the inspection, which typically costs between $300 and $800 depending on the size of the home. The cost is well worth it if you avoid paying thousands in major repairs later.

Don’t forget home insurance

Your mortgage lender will require that you get home insurance. There are different types of coverages and premiums can vary between insurance companies, so you should shop around to find the best homeowners insurance company for your needs. Be sure to get enough coverage to rebuild your home in case it is destroyed or damaged beyond repair. If you live in a flood-prone area, remember to get separate flood insurance.

How to Buy Your First Home FAQ

How long does it take to buy a house?

The home buying process generally takes four to eight months, although it can take longer in a competitive market. Most buyers spend an average of four months finding a home. Once your offer has been accepted, it can take another 40 to 50 days to close on your mortgage. Preparing financially for a home purchase can take at least a year.

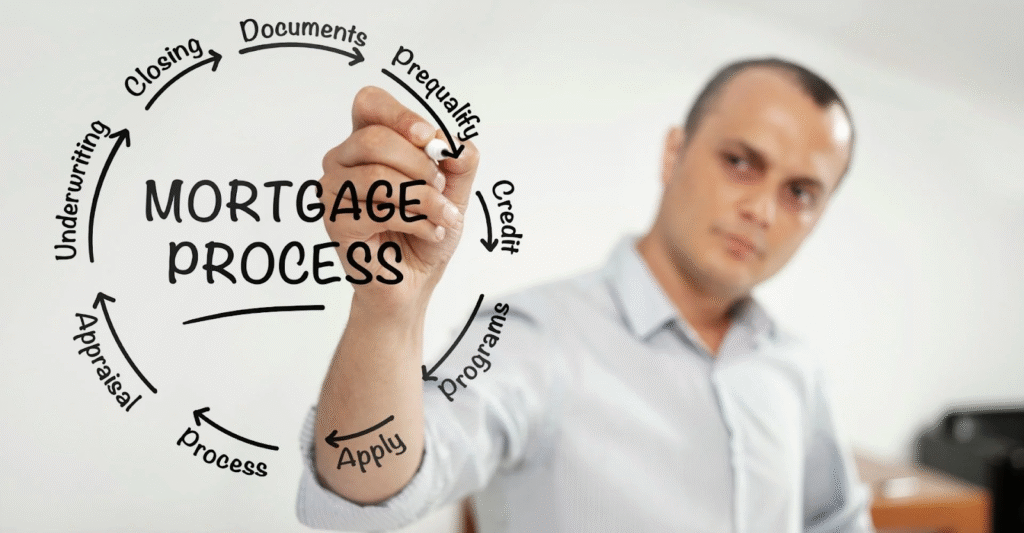

What are the steps to buying a house?

Your first step is to make sure you are financially ready to buy a home. Next, you want to determine how much home you can afford and set a budget. As the time to buy approaches, you want to secure your down payment, closing costs and any other expenses. Next, you’ll want to get pre-approved for a mortgage.

To start house hunting, hire a real estate agent familiar with the area you are targeting. Define what is an absolute must in a house. Once you find the right home, make a competitive offer. Your final step is closing on the property.

Who is considered a first-time homebuyer?

If you’ve never owned a home, you are considered a first-time homebuyer. However, the Internal Revenue Service, Housing and Urban Development Department and Federal Housing Administration define first-time homebuyers as anyone who has not owned a primary residence for the past three years ending on the closing date of the new purchase.

When is the first mortgage payment due after closing?

Your first mortgage payment is due on the first day of the month that is at least 30 days after your closing date. For example, if you close on any day in April, your first mortgage payment will be due on June 1. Subsequent payments will always be due on the first of each month. Your mortgage payments are paid in arrears, meaning that you’re paying for the previous month and not the current month.

How to Buy Your First Home Bottom Line

Buying a home requires preparation and patience but most people find it is ultimately worth all the effort. Following these guidelines can keep you on track and in control of your house hunting experience.

More Stories

House Loan Prepayment Tips to Reduce Interest

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need