A reverse mortgage could provide much-needed cash to cover costs such as basic living expenses, medical care, and home repairs. Still, numerous fees can make reverse mortgages prohibitively expensive for some homeowners. One particularly onerous expense is the lender-required mortgage insurance premium (MIP). If you have a home equity conversion mortgage (HECM)—which is backed by the federal government—you’ll pay an initial MIP at closing plus annual MIPs for the length of the loan.

Key Takeaways

- Reverse mortgages can provide much-needed funds during retirement, but high costs make these loans a poor choice for many homeowners.

- The most common reverse mortgage is the home equity conversion mortgage (HECM), insured by the Federal Housing Administration (FHA) and offered by FHA-approved lenders.

- HECM borrowers owe a 2% initial mortgage insurance premium (MIP) at closing plus an annual MIP equal to 0.5% of the outstanding mortgage balance.

- HECM MIPs are expensive, but they provide borrowers with several important protections.

- As reverse mortgages are open-ended, the interest and fees can accrue for a long time before you or your estate repays the loan.

What Is a Reverse Mortgage?

A reverse mortgage lets you convert some of your home equity into cash without selling the home. You don’t make monthly payments to a lender; instead, the lender gives you an advance on part of your home equity, either as a lump sum, a monthly amount, or a line of credit. Interest and fees accrue over the life of the loan, which becomes due when you sell the home, move out, or die.

To qualify for a reverse mortgage, you must be age 62 or older, have substantial equity in the home, and live in the home as your principal residence. If you get a HECM, which is the most common type of reverse mortgage, you must also attend a counseling session approved by the U.S. Department of Housing and Urban Development (HUD). Once approved, you can use the cash to pay for things such as basic living expenses, healthcare costs, home renovations, or even a new house if you have a HECM for Purchase loan.

What Is Mortgage Insurance?

With traditional mortgages (sometimes called “forward” mortgages), it is the lender—not you—who is protected by mortgage insurance when you default on your mortgage payments, die, or are otherwise unable to meet the mortgage terms.

Private mortgage insurance (PMI) and MIPs are not the same thing. PMI is generally required on a traditional mortgage if your down payment is less than 20% of the home’s purchase price and you finance with a conventional mortgage loan. If the Federal Housing Administration (FHA) backs your mortgage, however, you’ll pay MIPs. These include an up-front MIP equal to 1.75% of the base loan amount, plus annual MIPs for at least 11 years, regardless of the size of your down payment.

MIPs apply to all HECM reverse mortgages. Most proprietary reverse mortgages don’t require up-front or annual MIPs, but they often have higher interest rates.

Mortgage Insurance for Reverse Mortgages

Mortgage insurance works a bit differently for reverse mortgages. Instead of just protecting the lender, MIPs provide several important assurances to reverse mortgage borrowers.

At closing, you pay an up-front 2% MIP based on the maximum lending limit of $970,800 or the home’s appraised value, whichever is less. For example, if your home is valued at $250,000, the up-front MIP would be $5,000 ($250,000 × 0.02). You can pay it in cash or use the money from your loan.

After that, your lender charges annual MIPs equal to 0.5% of the loan’s outstanding balance. These premiums generally accrue over time, and you (or your estate) pay the amount once the loan is due.

How Much Does Mortgage Insurance Cost?

If you have a HECM reverse mortgage, your lender will charge you a 2% up-front mortgage insurance premium based on your home’s appraised value, up to the $970,800 maximum lending limit. After that, an annual MIP kicks in, equal to 0.5% of your loan’s outstanding balance.

Can I Avoid Mortgage Insurance on a Reverse Mortgage?

You can avoid paying MIPs by getting a proprietary reverse mortgage. However, the loan may cost more in the long run due to higher interest rates. On the other hand, you will owe up-front and annual MIPs if you have a HECM reverse mortgage.

However, you get several important protections in exchange for paying those premiums. Specifically, the loan proceeds are guaranteed (even if the lender goes out of business), and you or your estate will not owe more than the value of the home once the loan becomes due and the house is sold.

Do Reverse Mortgages Have Closing Costs?

Like traditional mortgages, reverse mortgages involve closing costs. You’ll generally pay the following expenses, for example, if you get a HECM loan:

- MIPs—a 2% initial MIP due at closing, plus an annual MIP that’s 0.5% of the outstanding mortgage balance

- Third-party charges—including for the appraisal, title search, title insurance, surveys, inspections, recording fees, mortgage taxes, and credit checks

- Origination fee—the greater of $2,500 or 2% of the first $200,000 of your home’s value plus 1% of anything over $200,000, capped at $6,000

- Servicing fee—up to $30 per month with an annually adjusting or fixed interest rate loan, and up to $35 per month if the interest rate adjusts monthly

- Interest—usually variable interest rates, which can increase over time

The Bottom Line

HECMs require you to pay up-front and annual MIPs. However, reverse mortgage insurance benefits the borrower, unlike traditional private mortgage insurance, which protects the lender.

If you decide a reverse mortgage is right for you, you could save money by shopping around and comparing loan costs. While lenders charge the same MIPs, the other loan costs—including origination fees, closing costs, servicing fees, and interest rates—vary by lender.

More Stories

House Loan Prepayment Tips to Reduce Interest

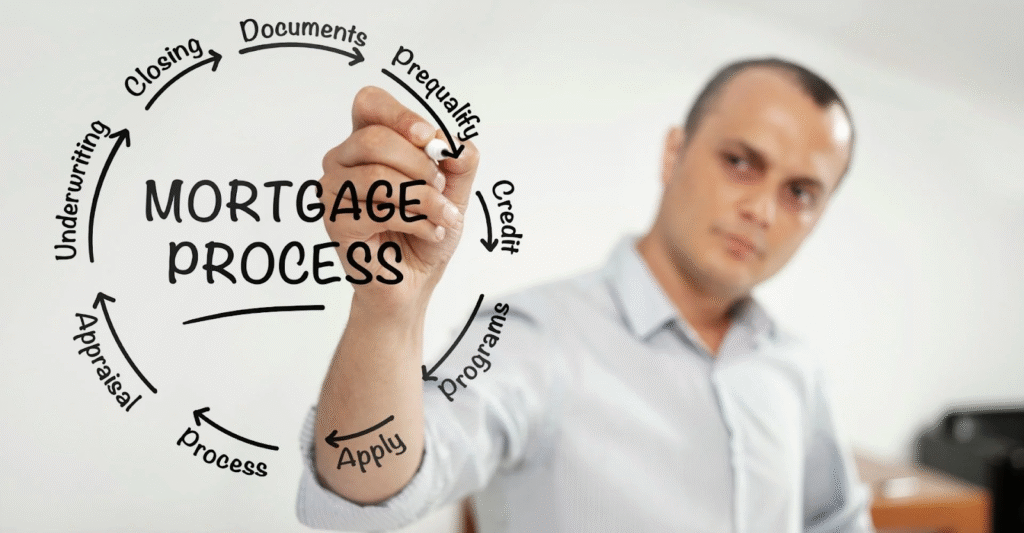

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need