Anyone who borrowed income to attend a school owned by Corinthian Colleges – a for-earnings institution with a very long historical past of defrauding pupils in advance of its sudden closure in 2015 – will have their federal student loans canceled.

The mass discharge is the biggest sum of credit card debt the federal governing administration has erased in one motion benefitting far more than a fifty percent million debtors to the tune of $5.8 billion.

“Although our actions right now will relieve Corinthian Colleges’ victims of their burdens, the Department of Instruction is actively ramping up oversight to far better protect today’s learners from practices and make guaranteed that for-financial gain establishments – and the businesses that have them – hardly ever yet again get away with these types of abuse,” said Schooling Secretary Miguel Cardona.

Corinthian Schools opened in 1995. Based mostly in California with campuses nationally, the colleges shut in 2015 just after the Education Department slice off the for-revenue institution’s capability to entry federal money. But debtors who had attended the faculty often nonetheless struggled to get their financial loans discharged.

The cancellation of the Corinthian Faculty personal debt also arrives as the President Biden considers broader student financial loan forgiveness, and payments on federal college student financial loans stay frozen. That pause is set to carry at the end of August.

About 41 million debtors profit from the pause, and the Education and learning Section has estimated it will save them about $5 billion a thirty day period.

Vice President Kamala Harris is expected to formally announce the credit card debt cancellation on Thursday at the Education and learning Department. She has a heritage with Corinthian Colleges.

As California’s state lawyer common, Harris secured a judgement against the establishment in 2016 that resulted in $1.1 billion in reduction for former learners. The initial criticism, filed in 2013, alleged the school targeted lousy Californians by means of advertisements and advertising and marketing campaigns that misrepresented the probability of pupils locating work.

The Schooling Office estimated that roughly 560,000 borrowers would be profit from the cancellation to the tune of almost $6 billion . The cancellation comes through the borrower protection software, a federal initiative that cancels the credit card debt of students who can verify they ended up defrauded by their colleges.

Borrowers with credit card debt associated from Corinthian Colleges will not have to implement for the relief. And in some cases, they will get refunds for payments they had previously designed.

The agency has formerly introduced alterations to current financial debt reduction courses that the department claims has resulted in $18.5 billion for roughly 750,000 debtors. The most huge-achieving revamp was of the General public Support Financial loan Forgiveness system, which has benefitted just about 113,000 borrowers.

Borrower advocates praised the news, but questioned if the department would cancel debts at other shut for-earnings colleges.

“This motion is lengthy overdue, but we hope it presents these debtors with a fresh new start out and an chance to chart a route in direction of a brighter, much more protected monetary long term,” mentioned Libby DeBlasio Webster, senior counsel for the Nationwide Student Legal Protection Network, a borrower’s advocate group. “We also hope today’s news is a signal that other decisions are on the horizon for countless numbers of equally situated college students who are waiting around for this type of reduction.”

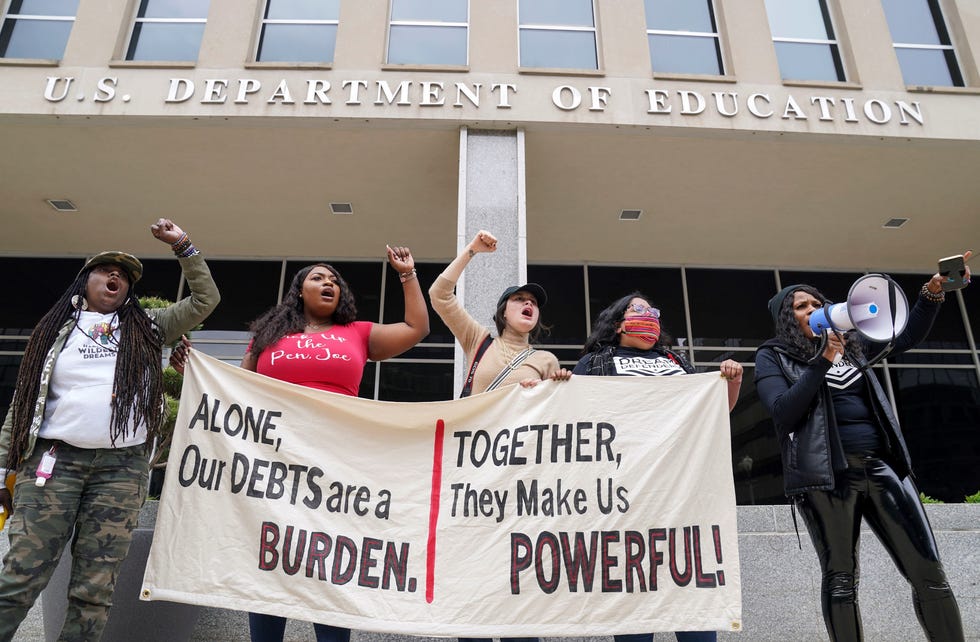

The Personal debt Collective, a national team of organizers performing towards pupil personal debt forgiveness, also praised the announcement. That team had also led a “pupil credit card debt strike” in 2015 designed up of previous college students from Corinthian College who claimed their levels had been fraudulent.

Thomas Gokey, a member of the Financial debt Collective, stated the borrower to defense rule was relatively mysterious till customers of the group started applying for relief from the Training Section.

One of the users of the original personal debt strikers – the team calls them the Corinthian 15 –Latonya Suggs, stated on a push simply call Wednesday afternoon that she was encouraged by the cancellation, but wished it covered all debtors.

“I am pleased at the end of the working day that our financial loans are staying discharged, but the struggle is not more than,” Suggs explained. “There is certainly way more that we have to do. And at the end of the day, it took way way too extended.”

More Stories

House Loan Repayment Strategies to Save Money

I Found Leaks in My Attic, What Do I Do?

Toilet Sink Combo – Puffs Ruffs N’ Stuffs