By Alejandro Lazo, CalMatters

Initial-time purchasers typically depend on family members gifts to afford the down payments on their houses. Now California Legislators want the govt to fill the job of generous relative.

Lawmakers are proposing making a billion-greenback fund in this year’s condition spending budget that would offer California’s initial-time potential buyers either all of the funds they need to have for a down payment, or incredibly close to it, in trade for partial ownership stakes in individuals residences.

The proposal, set forward by state Senate President Professional Tem Toni Atkins, arrives as skyrocketing residence costs broaden the divide in between people who possess their residences and all those who hire in California. In the earlier 12 months, Golden State homeowners obtained $141,000 in property equity, on typical, the housing investigate organization CoreLogic noted final week, a lot more than in any other state.

California’s charge of property ownership, at 56%, is 2nd most affordable in the region at the rear of New York, according to the American Neighborhood Survey info from the census.

Atkins mentioned the California Aspiration for All system is aimed at generating alternatives for reduced- and middle-revenue potential buyers in a speedily soaring industry, including people who have faced racial and economic boundaries to homeownership.

“The California Aspiration for All method will give additional persons the prospect to crack absolutely free from the cycle of renting,” Atkins explained previous thirty day period. “This has the capability to adjust people’s lives.”

The proposal is the issue of negotiations between the Legislature’s Democratic supermajority and Gov. Gavin Newsom, also a Democrat, on how to devote a projected spending plan surplus of $97.5 billion. The legislature handed a funds on Monday that incorporates the proposal, while negotiations with Newsom keep on on a closing overall paying program.

A spokesman for the governor declined to remark on the proposal, citing the ongoing negotiations. It was not provided in the governor’s initial spending plan nor in his May revised budget.

A multi-billion greenback fund

The housing proposal – which would simply call for issuing income bonds of $1 billion a year for 10 several years to build the fund — is the largest in a slew of proposals intended to advertise homeownership this yr. The proposal also features $50 million in the funds this yr, and $150 million per 12 months right after that to pay out for the administrative expenditures of the application and the curiosity charges of the revenue bonds.

The system envisions helping some 7,700 borrowers a year, in accordance to estimates made by the program’s designers centered on house rate projections. A begin date for the proposed plan has not been indicated.

If authorised, the system would start off issuing interest-cost-free next property finance loan financial loans covering up to 30% of a home’s acquire cost, even though lawmakers expect quite a few of the loans would address 17%, inquiring borrowers to consist of 3% of their personal revenue or pair the personal loan with other very first-time buyer applications.

The desire-free loans would be paid back into a state fund each time the home was offered, or if a bigger mortgage loan was acquired in a money-out refinancing. For instance, if the fund presented 20% toward the buy cost of the property, the fund would get again its first financial investment, as properly as a 20% share of any boost in the home’s benefit.

The plan would reinvest these proceeds, offering the fund the means to make new financial loans for eligible members, even if rates have risen appreciably.

As prolonged as home costs rise, the strategy would make fairness for people today who normally would have remained renters. The application also would produce plenty of returns for the state to help long term homebuyers.

If rates fall, house owners could possibly continue to attain some equity and the fund would take in the losses, system planners stated.

Making generational prosperity

The method is supposed to make as considerably flexibility as possible. Prospective buyers who have lived in historically minimal-income neighborhoods can obtain priority for some of the money and can use shared appreciation financial loans to obtain in their present neighborhoods or buy residences somewhere else.

“We need to make confident that the state’s homeownership aid application serves people today in all pieces of the point out, together with in its high price spots,” explained Micah Weinberg, chief govt of the nonprofit team California Forward, which oversaw drafting the proposal.

“We are not able to hold out until much more housing is constructed for these communities to get started to make the generational prosperity that they have been locked out of and deeply deserve,” he mentioned for the duration of a recent legislative listening to.

The software would be open to customers producing a lot less than 150% of the median earnings in their region, and it would focus on very first-generation homebuyers as well as these with high pupil credit card debt masses.

If accepted, the system would substantially make improvements to home affordability in California for the men and women awarded 1 of the loans, proponents say. If it experienced existed in 2021, for occasion, it would have lessened the once-a-year cash flow necessary to acquire a median priced house of $786,000 by far more than $30,000 to about $90,000, in accordance to Kate Owens, a principal at HR&A Advisors, Inc., a single of the financial consulting corporations employed to devise the software.

The program is unique from other down payment assistance plans in that most provide a great deal more compact payments, generally all over 3% to 5% of the buy rate, in the type of grants or loans.

The proposed point out fund enables householders to not put down a down payment, doing away with the will need to conserve for that preliminary financial investment, which Atkins reported is the greatest hurdle for a lot of buyers in today’s sector.

These equity sharing arrangements typically are referred to as shared appreciation mortgages. The California program would be the most significant tried experiment with this kind of house financial loans at any time established in the U.S., designers of the application said.

Much less can afford to pay for houses

In excess of a 40-calendar year period the program could help some 157,000 households with desire-totally free financial loans, claimed Gene Slater, chairman of CSG Advisors, one more consultancy hired to structure the method.

Lawmakers said they are making an attempt to do a lot more to help homeownership, especially now that the pandemic has spurred desire for solitary-family members attributes as distant workers seek out far more area, and as communities throughout the condition are falling woefully shorter of homebuilding goals.

“Until California certainly prioritizes reasonably priced homeownership, a technology of Californians will be efficiently barred from 1 of the most trustworthy sorts of prosperity era out there — proudly owning a dwelling,” said Assemblymember Tim Grayson, a Democrat from Concord, in April.

California’s residence rate boosts suggest affordability has plummeted, even much more so for Black and Latino people. Only 26% of California households general earned the minimum amount annual cash flow wanted to invest in a median-priced, one-family household last yr. Just 17% of Black and Latino households could pay for this kind of a home, in accordance to a report by the California Association of Realtors, which supports the development of the down payment fund.

“Homeownership provides operating households with the unparalleled capacity to accrue generational prosperity and knowledge monetary security through a mounted mortgage loan versus climbing rents,” reported the California Homeownership Coalition, a group that consists of the Realtors, the California Setting up Business Affiliation and Habitat for Humanity.

“These funding solutions are especially important for communities of color still going through disproportionately lower homeownership prices because of a long time-very long discriminatory housing procedures.”

Opportunity difficulties

Richard Inexperienced, director of the College of Southern California’s Lusk Middle for True Estate, set ahead a competing study proposal that was not selected by the point out. He supports the objectives of the one under thing to consider but is involved about how complicated it is.

“There are loads of items in lifetime the place the plan strategy is excellent (but) executing it is tough,” he stated, including that whilst the software would only be a portion of the state’s substantial housing marketplace, it could lead to rising prices if it received bigger. “If this method scales it would pretty much definitely have at the very least some affect.”

Andrew Caplin, a professor at New York University who wrote a reserve on shared fairness courses, reported he is eager to see the principle take off, but he has mostly promoted the strategy for private buyers, not governments.

Caplin did not research the California system, but he claimed he would be worried that politicians may well feel pressured to not demand from customers reimbursement and “in the conclusion, it will all be agreed that we simply cannot actually gather the funds — like student financial loans.”

Another person else’s mortgage loan

Experienced it been in existence, the software could have helped a homebuyer these as Aralyn Tucker, 29, who moved to Sacramento in 2017 since she was priced out of the housing market place of her hometown of San Jose.

Tucker, who has a master’s diploma in general public plan and administration from Sacramento Condition University, operates in human resources at a non-public school. She was only ready to manage a two-bedroom condominium in Sacramento right after her dad and mom contributed most of the down payment as a gift.

Getting a home was important, she claimed, since her loved ones had moved at minimum 4 times before she turned 18, at times into unstable housing cases.

“Creating that generational prosperity and developing that safety has been genuinely important to my moms and dads,” she explained.

Down payment support was significant, because her home loan payment is only $200 additional than lease, she claimed, but she couldn’t help save for the down payment on her individual.

“Folks in my generation, we have so several extra bills that we’re not able to established that hard cash aside as a down payment,” she stated.

“Here I am generating plenty of funds to afford $2,200 in hire each individual thirty day period that I compensated on time just about every thirty day period, and nonetheless, I would not qualify for a property finance loan mainly because I don’t have the down payment,” she said. “We’re continuously behind and we’re paying into a technique that does not give nearly anything again to us with regards to equity. I’m having to pay an individual else’s home finance loan.”

This posting is component of the California Divide undertaking, a collaboration among newsrooms analyzing income inequality and financial survival in California.

CapRadio delivers a trustworthy source of information for the reason that of you. As a nonprofit corporation, donations from persons like you sustain the journalism that makes it possible for us to find stories that are critical to our audience. If you believe in what we do and guidance our mission, be sure to donate nowadays.

More Stories

House Loan Prepayment Tips to Reduce Interest

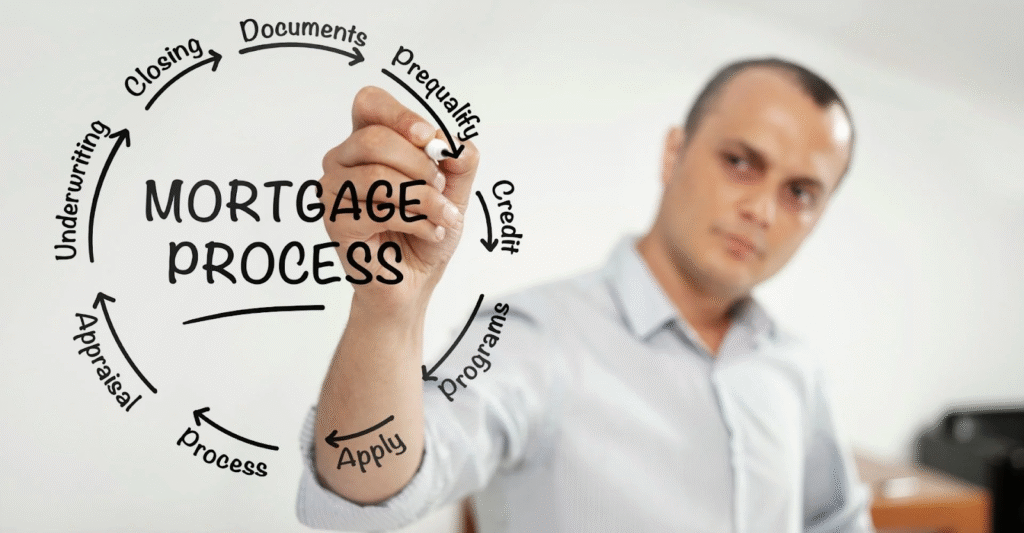

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need