Millions of pounds in pupil financial loan debt could have been cancelled presently experienced the scholar financial loan equipment labored properly, in accordance to a authorities watchdog.

A new report by the Federal government Accountability Business (GAO) appeared into revenue-driven compensation (IDR) ideas and uncovered that as of June 1, 2021, close to 7,700 university student financial loans had been thanks to be forgiven beneath present rules — but the Education and learning Section (ED) experienced only authorised 157 loans to truly be discharged.

“Until Education normally takes techniques to handle this sort of problems, some debtors might not obtain the IDR forgiveness they are entitled,” the report stated. “This chance will improve as Training info demonstrate financial loans potentially qualified for IDR forgiveness will climb to about 1.5 million loans by 2030.”

IDR ideas allow university student financial loan debtors to drop their month to month payments to as lower as $ if their cash flow dips under a certain threshold. If they entire 10, 20, or 25 many years of payments, depending on their strategy, they qualify to have the relaxation of their credit card debt composed off by the federal government.

“Today’s GAO report confirms really serious troubles with the administration of Money-Driven Repayment options, which were being meant to provide as a safety net for lower-cash flow college student debtors and offer them with a obvious path to bank loan forgiveness,” Household Training and Labor Committee Chairman Bobby Scott (D-VA) stated in a statement on Wednesday.

In a letter within just the report, Federal Pupil Aid Chief Running Officer Wealthy Cordray acknowledged various suggestions by the GAO and stated that he’s “committed” to improving upon the experience for college student debtors by adopting new measures.

IDRs were being an Obama-era initiative

The GAO report highlighted how the IDR initiative — executed by the Obama administration to deal with increasing student financial loan credit card debt — has largely unsuccessful.

“We… were extremely focused on attempting to boost income-driven compensation strategies and our hope was in the Obama administration that income-pushed repayment would aid address the college student debt disaster,” John King, a previous Schooling Secretary in the Obama administration, advised Yahoo Finance lately. “But the reality is, it has not.”

About $500 billion in remarkable federal Immediate Loans are becoming repaid by borrowers by way of IDR, according to the GAO.

Why only 157 and not 7,700 pupil financial loans have been cancelled

The GAO report highlighted how a absence of details hindered accurate payment counts and led to confusion about cancellation of debt.

About 70,300 loans had been in compensation long ample to quite possibly qualify for forgiveness as of September 1, 2020. Of these financial loans, 62,600 did not qualify for forgiveness, including 2,700 that had been in default.

A further 7,700 loans that ended up in repayment — all over 11% of the loans analyzed — could be “potentially qualified” for IDR forgiveness, but the government’s compensation facts did not present sufficient data on why these loans had not been forgiven back again in September 2020. ED authorised cancellation for 157 financial loans underneath IDR as of June 1, 2021.

“Training officials reported facts limitations make it challenging to keep track of some qualifying payments and more mature loans are at bigger possibility for payment monitoring problems,” the GAO report stated.

A recent NPR investigation thorough systematic mismanagement of the payment depend, which includes how paperwork generally went lacking when financial loans transferred from just one servicer to a further around the decades.

The GAO stressed that the dilemma wanted an urgent resolve.

“Until Instruction usually takes measures to tackle this kind of faults, some debtors may well not get the IDR forgiveness they are entitled,” the report stated, incorporating: “This hazard will raise as Education data exhibit financial loans likely qualified for IDR forgiveness will climb to about 1.5 million financial loans by 2030.”

Biden’s most recent effort and hard work to cancel debt

The Biden administration has recently taken methods to address the massive IDR debacle, bringing debtors on 10- and 20-yr forgiveness programs nearer to the end objective in two means.

ED ongoing its university student mortgage cancellation energy by offering borrowers retroactive credit for “forbearance steering,” a exercise involving scholar personal loan servicers pushing debtors into pointless desire-accruing forbearance.

ED also mentioned it will also consider increased care to correctly keep track of month-to-month payments for debtors on IDR.

Alongside one another, the information is expected to terminate the student financial debt of 40,000 borrowers who are underneath the Community Support Loan Forgiveness (PSLF) application though 3.6 million far more will go closer towards forgiveness.

Lawmakers lauded ED’s recent moves to deal with the broken IDR procedure, noting that they will probable assist lots of who may be having difficulties with their college student financial debt.

Rep. Scott said that he was “delighted that the Biden-Harris Administration introduced methods to take care of the problem and assist learners obtain the personal loan forgiveness to which they are entitled.”

Advocates, meanwhile, slammed ED for not accomplishing much more.

“The failure of the ED to just take obligation for it and its servicers failures is inexcusable,” Persis Yu of the College student Borrower Protection Centre claimed in a statement. “For eight a long time, borrowers have been robbed of time that ought to depend toward financial debt cancellation and ED did absolutely nothing to enable them.”

Yu stated that ED’s go to reform IDR “is a superior to start with move to cure some of the problems recognized in the GAO report, but it does not go significantly adequate.” She called for ED to also rely time expended in default as on-time regular monthly payments created towards the 20- or 25-yr forgiveness program.

“The troubles discovered recommend a significantly further systemic challenge in just the college student financial loan program,” Yu added. “We cannot count on unique programmatic fixes to correct systemic problems. Common debt cancellation is desired quickly.”

—

Aarthi is a reporter for Yahoo Finance. She can be reached at [email protected]. Adhere to her on Twitter @aarthiswami.

Browse the newest fiscal and company information from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Fb, Flipboard, and LinkedIn

More Stories

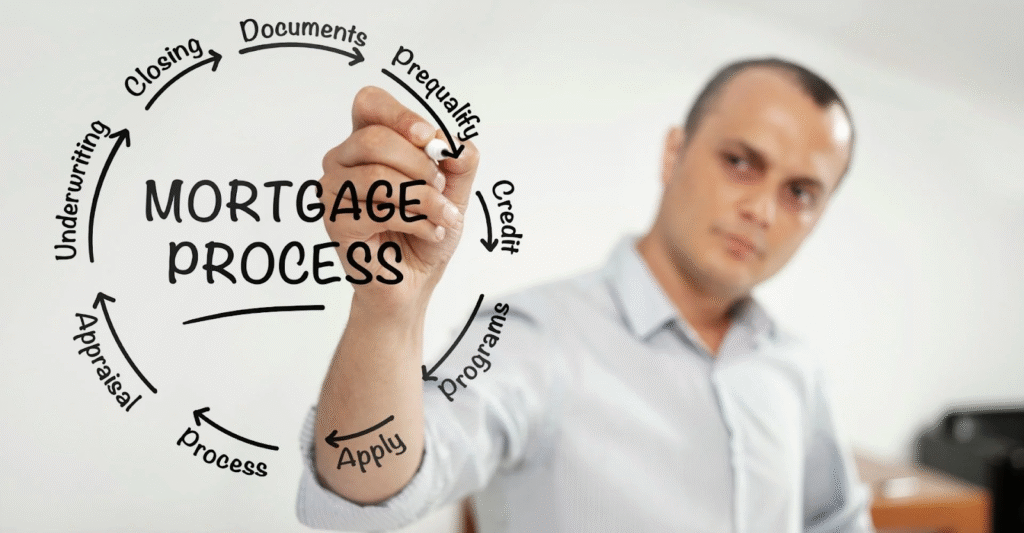

House Loan Prepayment Tips to Reduce Interest

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need