Image source: Getty Images

The major purpose is to leave by yourself plenty of to stay a good everyday living.

Vital factors

- A competitive housing current market can tempt men and women to devote more than they really should.

- The housing current market will wax and wane, but you usually want to have ample money remaining following your housing payment to help you save for a rainy day.

We might be lying if we said that now is an effortless time to be a household hunter. If there are a dozen other parties lined up to make an offer on just about every house that appeals to you, you may well come to feel as though you can not compete.

If that’s the scenario, you may possibly be wondering about increasing the amount of money you might be eager to pay. Just before you do, although, make sure every of these five symptoms apply to you and your fiscal problem. If you can reply “sure” to just about every of these concerns, you may perhaps be in a place to increase your spending plan.

1. Will my credit card debt-to-earnings ratio continue to be in line if I elevate my budget?

Financial debt-to-income ratio (DTI) refers to the volume of cash you shell out each thirty day period to are living in contrast to how a lot you make. For instance, if you receive $80,000 for every 12 months, which is $6,666 for each thirty day period (just before taxes are taken out). Let’s say the expenditures you are obligated to shell out every single thirty day period (including home finance loan, vehicle, credit rating cards, personalized loans, boy or girl guidance, and other money owed) sum to $2,500 for every month. You divide the whole of your charges by your cash flow to come up with your DTI. This is how it would glimpse:

$2,500 ÷ $6,666 = .375. Your DTI in this scenario would be 37.5%. Ideally, most creditors like to see a full DTI of 36% or much less, and figures point out that folks with DTIs around 36% tend to operate into extra economical issues.

Now, here is exactly where it gets tricky. Some home finance loan loan providers will lengthen loans to people today with better DTIs. Even though which is fantastic for their business enterprise, you have to decide whether it really is great for your monetary life. Do the math and if raising your house budget cuts you shut, you know now is not the proper time.

2. Can I still find the money for to do the matters I really like?

If you’ve ever been household-inadequate, you know the distress of investing so considerably money on a house loan that you you should not have the resources remaining to only get pleasure from lifestyle. If you have a interest that implies a thing to you, you want ample remaining to go out for nice dinners, or aspiration of vacation, pouring all the things you earn into a residence is probable to get outdated at the time the excitement of moving working day wears off.

3. Will I however have ample to place away for a wet day?

A single of the most surprising items about remaining a house owner is how substantially you are going to shell out in concealed costs. You are not just responsible for a mortgage loan. There is certainly also home owners insurance plan, utilities, HOA fees, upkeep costs, and more. Some of those expenses can be planned for, but when your furnace breaks down on Xmas Working day and you have to dig deep to fork out anyone to occur out and repair it, you can expect to want a strong crisis fund obtainable.

Ahead of elevating your housing spending plan, run the quantities. Make certain you can have enough income place away to get you by unexpected emergency cases.

4. Can I even now prioritize saving for my future?

No make a difference your present age, portion of dealing with yourself well is setting up for your fiscal potential. For some, that signifies early retirement. For other individuals, it indicates an annual vacation to a faraway spot. And for many of us, it implies a at ease retirement. Except if you can nonetheless make investments money in your long term self, you may possibly not be completely ready to raise your residence looking price range.

5. Can I pay back the house loan devoid of relying on anyone else?

Even if you’re obtaining the household with a associate, take into account what would come about if that human being died or still left. Would you still be able to make the home loan payments until you can make other preparations (like promoting the residence or bringing in a roommate)?

If you’ve got answered a resounding “sure” to every of these issues, congratulations. You might be ready to increase your housing budget. Just make confident it’s your choice and you’re not pressured into creating a bad determination.

A historic possibility to possibly preserve hundreds on your house loan

Possibilities are, curiosity premiums will not likely remain put at multi-ten years lows for considerably lengthier. That’s why getting motion today is important, no matter whether you’re wanting to refinance and lower your mortgage loan payment or you are prepared to pull the induce on a new house buy.

The Ascent’s in-home mortgages specialist suggests this company to find a low rate – and in reality he used them himself to refi (twice!). Click in this article to learn more and see your fee. Though it doesn’t affect our viewpoints of merchandise, we do obtain payment from partners whose delivers seem in this article. We are on your aspect, usually. See The Ascent’s total advertiser disclosure here.

More Stories

House Loan Prepayment Tips to Reduce Interest

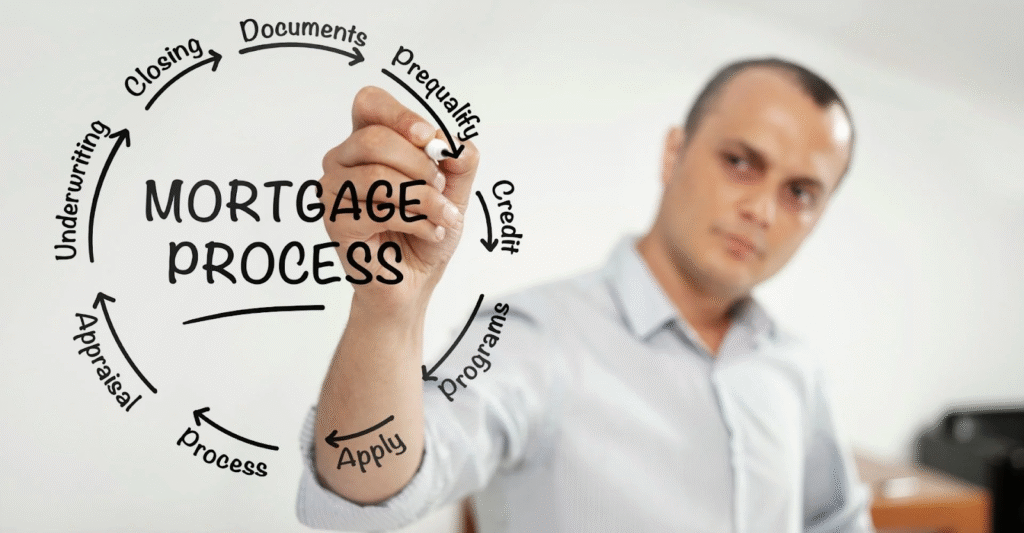

Step by Step Guide to the House Loan Process

Essential House Loan Documents You’ll Need